Retrospective 2016 – looking back; looking ahead on e-payments

There can be no doubt about it. If there is anything that 2016 will be remembered for in India, it will be the ‘de-legalisation’ of Rs.500 and Rs.1,000 notes. Popularly referred to as demonetisation, this move sucked out overnight almost 86% of the currency in the markets. Thus the economic contraction was inevitable.

In retrospect, it is now clear that demonetisation did not achieve all its objectives.

In retrospect, it is now clear that demonetisation did not achieve all its objectives.

It was expected that the financing of terrorism would stop. But the number of bank robberies in sensitive areas points to serious lapses that could frustrate this objective.

Similarly, it was expected that around 30% of the currency would not find its way back to the banks – thus requiring it to be extinguished (http://www.asiaconverge.com/2016/11/post-demonetisation-three-steps-government-take/). Now it is almost certain that not more than 10% of the currency will get extinguished.

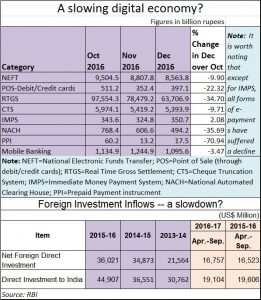

Again, many said that demonetisation will lead to a surge in e-payments. But as the chart alongside shows, almost every type of e-payment – except for IMPS — registered a decline.

Nevertheless, the government has now managed to build a large database of people and entities who have collectively deposited around Rs.13 lakh crore (Rs.13 trillion) in banks. Using data analytics, the government now has the means to identify people who have not been paying their taxes for years.

What remains to be seen is whether only the small and medium sized fish get caught; or whether the big ones will be caught as well. The past is full of anecdotes of the big fish being targeted initially. A lot of sound and fury follows. But the cases are allowed to be forgotten.

The government should bring to conviction and closure of innumerable high profile cases. The list is long. The amounts involved staggering. Take a sampling – the Maharashtra Cooperative Bank Scam, the Irrigation Scam in Maharashtra, the 2-G scam, the Maxis scam and the investigation into Chaggan Bhujbal. Moreover, the government has yet to order an enquiry into the manner in which funds were squandered in Air-India (http://www.asiaconverge.com/2013/11/crash-of-air-india/). After all, there is at least one court judgement pronounced by a Canadian court which implicates a former Union minister in this matter (http://www.asiaconverge.com/2016/05/how-air-india-was-allowed-to-crash/). None of such cases has been brought to9 a closure.

The government needs to convince people that it is actually against corruption (http://www.asiaconverge.com/2016/12/gst-and-govt-corruption/). For instance, the government must now begin investigating the 8 lakh assessees who – in 2011 and 2012 – declared agricultural incomes which total to over eight times India’s GDP (http://www.asiaconverge.com/2016/11/demonetisation-modi-gone-8-lakh-wealthy-farmers-not-common-man/). They declared a cumulative income of a whopping Rs.874 lakh crore for the two years (http://www.asiaconverge.com/2016/11/post-demonetisation-three-steps-government-take/). That figure represents 79 times the taxes collected during the two years. If the income claims are wrong, the tax authorities must ask the police to file cases for false declarations and cancel these submissions. This is what was done when a Mumbai businessman declared an income of Rs.2 lakh crore, and an Ahmedabad maverick declared an income of over Rs.13,000 crore.

The government must also work out ways to reduce corruption promoted by state governments and municipalities. In fact, the government itself remains the biggest source of corruption (http://www.asiaconverge.com/2016/12/want-to-uproot-corruption/).

The best way to bring corrupt officers to heel is by allowing citizens to complain that they have paid a bribe (http://www.asiaconverge.com/2016/06/slush-around-defence-deals-bribe-givers-penalised-bribe-takers-seldom-convicted/). This cannot be done now, because current laws consider bribe givers as guilty. If they complain, they can be jailed promptly. Unless bribe givers are allowed to complain, how will documentation against bribe takers ever get compiled?

The government must also work on rebuilding investor confidence. Foreign investments appear to be slowing down. For three years this figure was climbing (see chart). Now it appears that this number will slacken for the year.

This is serious because without investment inflow, employment generation will become difficult. The government’s very survival depends on creating jobs.

It is heartening to see the impressive plans the shipping ministry under Nitin Gadkari has chalked out for generating over a crore jobs by galvanizing India’s coastline and waterfronts (http://www.asiaconverge.com/2016/12/coastline-and-waterways-mean-jobs/). But implementing such plans will require investment of around Rs.4 lakh crore. Some of it will have to come in from private players. But investors aren’t biting because the government has not assured investors that their investments will be safe (http://www.asiaconverge.com/2016/11/where-will-the-jobs-come-from/).

True, the government has impressive plans. But good plans make a difference only if they are implemented well. And people trust governments only if they know that there is an effective grievance redressal system in place. Currently, the track record of booking culprits is poor. Moreover, the government must improve the investment climate by assuring foreign investors that their investments will be safe.

Those should now become top priorities for the government. Else it may not be a very happy new year.

COMMENTS