It will be difficult times ahead for the Indian economy

r.n.bhaskar

Many sectors of the Indian economy have witnessed a sharp slowdown. This has been acknowledged both in the Economic Survey 2017 and the Union Budget 2017 tabled before Parliament a fortnight ago.

However, last week, two reports pointed to the pain that could lie ahead.

However, last week, two reports pointed to the pain that could lie ahead.

First comes the issue of dealing with black money. Demonetisation does point to where some of the black money could have come from. But the next steps of

(a) identifying people and entities,

(b) building a watertight case against them, and

(c) actually penalizing them

are steps that remain to be taken. If the past two years are any indication, the government may decide to deal with culprits very selectively. That would be extremely unfortunate.

Consider for instance the way the income tax department sought to whitewash the incredible surge in agricultural income declaration (http://www.asiaconverge.com/2017/02/agriculture-aslaundromat-error-or-coverup/). Instead of penalising those who had submitted false returns, the department tried to pass them off as data entry errors. The fact is that all data for incomes over Rs.10 lakh a year have to be filled in online by the assessees themselves. It was thus a surefire case of wrongful declaration or of tax evasion. The department has chosen not to apply any of these provisions.

And the amounts involved are not small. At Rs.874 lakh crore at the very minimum (the public interest litigation before the Patna High Court puts the figure at Rs.2,000 lakh crore) the amount represents at least five times the GVA (Gross Value Added) for the two years combined. It also represents 66 times total direct taxes collected over those two years.

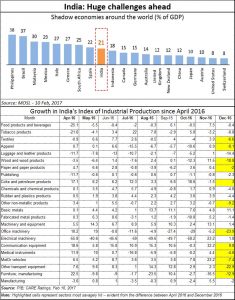

Then there is the quantum of black money swishing around in India. While the MOSL report puts the figure at 20%, there are other economists who belie that it could be as high as 40%. Their estimates are based on a careful study of the transport sector. The number of trucks plying up and down suggests more economic activity than is currently reported. Using complex algorithms and statistical tools, these analysts estimate black money to account for as much as 40% of total GDP.

Can the government stanch this leakage? The finance minister says it can.

But there are two problems which will continually frustrate such efforts. The first is the gaping loophole of agricultural income. As long as the government allows all agricultural income to be tax free, this route will be used as a means to launder funds. If the finance ministry is serious about curbing black money, he should put a ceiling on the quantum that can be tax-free. Hence if there is income of more than Rs.5 lakh an acre, it should lose its tax exemption. Or if the income declared is over Rs.50 lakh, income tax rules should kick in. But this has not been done. Powerful interests – which includes most legislators – want this loophole to stay intact.

The second is the quaint provision in the budget that political parties can now accept (anonymous) cash donations of a maximum of Rs.2,000 per transaction, as against Rs.20,000 earlier. That is a big joke! Even if it is brought down to Re.1, all that the political party will have to show in its books is that a crore people gave donations of Re.1/-. Remember, this was the explanation that Mayawati, former chief minister of UP, gave to the tax authorities to explain her huge cash income. The finance minister has tried pulling wool over the eyes of the nation.

Then take the sectors that have been severely affected. According to CARE Ratings, industries related to households like motor vehicles and parts, furniture, medical equipment, luggage, textile, garment, food products, non-metallic (includes cement linked with housing) witnessed negative growth. Overall 17 of the 22 classified industries in manufacturing witnessed negative growth. Watch the highlighted sectors and you will discover that the pain is truly widespread.

To galvanise the economy the finance minister will have to focus heavily on two of seven areas (http://www.asiaconverge.com/2017/01/7-things-the-govt-should-do-in-budget-2017/). He has to bring in vast amounts investments to finance infrastructure building in a major way. That will create jobs, and ease the pain. It will revive industries as well. And he has to curb government corruption (http://www.asiaconverge.com/2016/12/gst-and-govt-corruption/).

If he can achieve these two objectives then demonetisation will be a big hit. It will go down as a measure that is transformational. If he can create jobs, his party will be assured of a win in the next general elections. If he fails in both, it could be a repeat of Mohammed bin Tughlaq. The reasoning might have been correct, but the consequences made them appear whimsical.

Will the government move quickly to remedy the situation?

COMMENTS