https://www.firstpost.com/business/splurging-money-on-mega-welfare-schemes-sans-planning-not-wise-govt-should-find-a-way-to-make-them-productive-6154241.html

From splurge to dirge – this this the future for India?

RN Bhaskar — Feb 26, 2019

In the few months leading to the general elections, the government has launched least two ‘largest-in-the-world’ schemes. One is the Ayushman Bharat scheme. The other is the PM Kisan (Pradhan Mantri Kisan Samman Nidhi Yojana). Both are great ideas. But both are likely to spell disaster because they have not been carefully thought out. Obviously, both schemes envisage a huge cash outflow.

Take Ayushman Bharat first. It is meant to reach out to 10 crore families or 50 crore beneficiaries. Each family has a cover of Rs.5 lakh a year. It is touted as the ‘world’s largest government funded healthcare programme’. The total outlay is Rs.50 lakh crore (whew!).

Take Ayushman Bharat first. It is meant to reach out to 10 crore families or 50 crore beneficiaries. Each family has a cover of Rs.5 lakh a year. It is touted as the ‘world’s largest government funded healthcare programme’. The total outlay is Rs.50 lakh crore (whew!).

The PM Kisan scheme, in comparison is a lot more modest, but extravagant nonetheless. While it is initially targeted at 1 crore households, each of whom will get Rs.6,000 annually, the eventually plan is to cover some 12.5 crore households, thus resulting in a cash outflow of Rs.75,000 crore. Rs.2,000 represents the first instalment (of the Rs.6,000) and is to be disbursed right away. Thus, the immediate outgo is around Rs.2,000 crore. This too is touted as the world’s largest farm sector scheme.

Cut through the hype, and you begin to realise that both the programmes are jinxed.

Why Ayushman Bharat is a jinx?

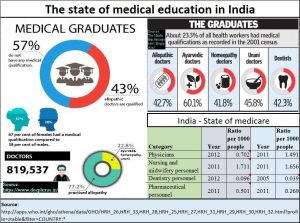

Take Ayushman Bharat first. For any insurance programme to work, you need – in addition to the money – good doctors and good hospitals. It is good doctors who decide what treatment should be given to which person. Then you need the hospitals where the treatment is to be carried out. Now look at the table alongside. India has fewer doctors per 1,000 people compared to most countries in the world. It still does not have protocols and standards for pathology in place. And even its best government-owned hospitals treat patients so inhumanely – just look at the long queues for the ailing. It can be a dehumanizing experience.

The simplest thing the government could have done was to de-licence medical education. That would have created more doctors in a few years’ time. It is shortage of seats with medical colleges that causes the capitation fee (or donation demands) to spiral to over Rs.1 crore per seat in private colleges. Today, medical colleges in China offer the best quality of medical education (taught in English with excellent teachers from all over the world) at a fraction of this cost.

A five-year residency and tuition cost in China is just around Rs.15 lakh. How can the Indian government offer reasonably priced medicare unless the fees paid by aspiring doctors are kept low. This can be done only by increasing the number of medical colleges, though with strict controls on the quality of output. Government incentives for medical colleges and low fees could make this viable (http://www.asiaconverge.com/2018/08/ayushman-bharat-great-concept-doctors-overlooked/).

But the government has not done this. Possibly, the politicians who back medical colleges want to continue to benefit from the capitation fees. Medical education needs to be removed from the licence raj.

As a result, the Rs.5 lakh per household insurance cover will be like honey for flies. Small clinics and pathology units will swarm to rural areas to offer their services. The only difference is that many of them will not uphold standards. This will lead to sub-standard diagnosis, poor quality medicare, and collusive relationships between the (below-par) doctors, pathology clinics and insurance companies.

The government’s solution is forcing all private hospitals also to be registerd under Ayusshman Bharat could boomerang. As a senior hospital administrator puts it, the fees offered for each line of treatment are so low that no good doctor would be willing to take up this assignment. Result, doctors whom few would go to would be available. But good hospitals would not like such doctors to practise on their premises. Consequence: even good hospitals may have to close down, or compromise and become sub-standard themselves.

This is a scheme that will destroy medical ethics on the one hand, and even corrode existing quality medicare centres on the other. It will end up corrupting the very little fabric of medicare that this country has.

Farmer doles will cripple farmers

Take the PM Kisan scheme next. There is an old saying that governments must ensure that people do not discard their ethics related to repayment of loans, or their belief that work is worship.

When the government came to power, it assiduously kept away from loan waivers. But then all values were thrown to the winds when the UP state elections were announced. Farm loan write-offs were announced. It wasn’t long before every state had farmers clamouring for the same ‘benefit’.

In reality, loan waivers are not a benefit. They corrode a community’s willingness to be responsible earners and spenders. They teach the honest to become dishonest. They pollute communities which once took pride in repaying their obligations – even obligations notched up by their grandparents. You teach them not to repay loans. The results are inevitable. Good lenders shy away from giving loans to people who have lost their intent to repay. The only ones then willing to lend money are the loan-sharks who are used to high-risk and extremely high returns. You just cannot wish them away, because now the government itself has created a vacuum by frightening away good lenders (http://www.asiaconverge.com/2018/05/cattle-slaughter-ban-missteps-may-factor-bjps-electoral-woes/).

The PM Kisan Yogna is a move in the same direction. It tells people that money is easy to come by. It reduces a proud, god-fearing community into an army of dole-seekers.

Had the government been sensible, it would have offered farmers a dole of things that are productive. It could have linked the dole to banks who would allow them to purchase a couple of cattleheads, or goats, or layer hens. That would have helped farmers get an additional source of income. It would have eased farmer distress. It would have prevented them from learning how to splurge cash just because the government itself has picked up the habit of splurging.

In economics, everyone knows that it is easy to push up GDP numbers. You give money to people to dig wells. Then you give them money to fill up those holes. Yes, work has been created. Money has been given out. But the ‘assets’ created through such expenditure is essentially non-productive. It is not the same as building a road, or a bridge, or a check-dam. The latter class comprises productive assets.

True, GDP numbers climb. But they are not sustainable. When a government creates unproductive assets, or splurges money on non-productive work, it merely stokes inflation. That in turn only triggers inflation. Which in turn causes the currency to depreciate.

It is therefore no wonder than the Indian rupee has been sliding. Three months ago, rupee punters were predicting an exchange rate of Rs.75 to a dollar. Now they are predicting Rs.85!

More off-budget spending

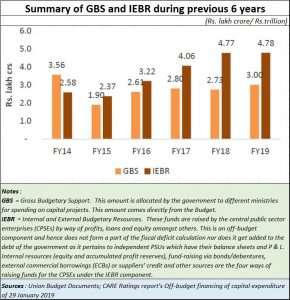

Unfortunately, the splurge does not merely end with these two examples. By January 2019, a research paper by CARE Ratings showed that the government had already resorted to off-budget spending, by taking (not borrowing) money from public sector units (see chart).

Unfortunately, the splurge does not merely end with these two examples. By January 2019, a research paper by CARE Ratings showed that the government had already resorted to off-budget spending, by taking (not borrowing) money from public sector units (see chart).

Come February, and you have the government taking money from the RBI, and from the seven PSUs who have concertedly gone in for share-buyback and other schemes to transfer funds to the government. The RBI is paying Rs.28,000 crore to the government by way of interim dividend. The PSUs are paying another Rs.17,000 crore. The PSUs include Coal India, NHPC and NMDC.

What this means is that money that could have been used responsibly by PSUs for expansion or becoming more competitive is now being used for splurging by the government. It is legal, tru. But is this ethical? The money that RBI has given away is money that it used for market operations to stabilise the rupee. Now it will have lost much of its ability. So when there is a run on the rupee, the RBI may not be able to stanch the fall effectively enough.

This is where the government’s planners have evidently lost their sense of proportion, their perspective of right and wrong, and also of what is good for India. Handled sensibly, such schemes could have both garnered votes, and made the country stronger too.

COMMENTS