https://www.freepressjournal.in/analysis/high-costs-bedevil-india

Judicial delays, import duties and corruption make business a high cost affair

RN Bhaskar – 11 July 2019

When Prime minister Modi won at the hustings with a thumping majority, there was a resurgence of hope. Maybe, Modi 2.0 would be able to set the nation on the right track and kickstart an economy that was clearly slipping. After months of denial, the government grudgingly admitted that unemployment was at an all time high during the past four decades. GDP growth had slowed down as had the Index of Industrial Production (IIP) — http://www.asiaconverge.com/2019/05/even-the-iip-suggests-that-india-has-a-painful-six-months-ahead-unless-it-is-only-when-one-goes-to-the-components-that-ma/.

Many saw Modi as the only savior – the man who could turn things around. But, after the Economic Survey and the Budget (http://www.asiaconverge.com/2019/07/budget-2019-is-disappointing/) were presented before the Parliament many have begun feeling a bit despondent. The Economic Survey talked of India becoming a $5 trillion economy by 2025. One of the imperatives to achieve this figure was to grow GDP by 8% annually. In order to do this, job formation and exports become prerequisites. That would require lots of foreign direct investment (FDI) – especially private investment.

Many saw Modi as the only savior – the man who could turn things around. But, after the Economic Survey and the Budget (http://www.asiaconverge.com/2019/07/budget-2019-is-disappointing/) were presented before the Parliament many have begun feeling a bit despondent. The Economic Survey talked of India becoming a $5 trillion economy by 2025. One of the imperatives to achieve this figure was to grow GDP by 8% annually. In order to do this, job formation and exports become prerequisites. That would require lots of foreign direct investment (FDI) – especially private investment.

Could that be done?

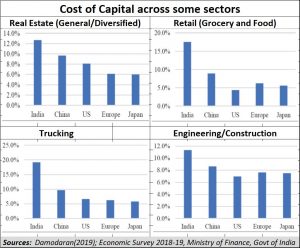

One chart from the Economic Survey is quite telling. It tells you that capital formation costs in India are higher than those of other countries by at least 25-100%. Why?

There are several reasons for this. One is simple and can be remedied almost overnight. Capital costs are high because of import duties and other imposts. Can these duties be reduced? Of course, this can be done provided one of two things happen. The first would be the government’s ability, and willingness to spend less. The second would be to streamline operations so that the cost of doing business gets minimized.

The first depends on intent. For instance, there is no need to keep a 25% rate of import duty on solar panels. After all, solar imports allow the government to achieve three things:

- replacing a polluting fuel with a clean renewable source of energy – sunlight.

- rooftop solar could reach even the remotest village with attendant capital costs less than half of the conventional grid-wire costs – as the installation of 50,000 rooftop solar units in Tripura has already shown (http://www.asiaconverge.com/2019/03/biplab-kumar-deb-has-big-plans-for-tripura/).

- the absence of power theft, the availability of more reliable power without shutdowns, and the virtual elimination of monthly power subsidies, because the solar power would be available free of cost for at least 300 days a year.

- Moreover, rooftop solar has the potential of creating 80 million jobs within a couple of years (http://www.asiaconverge.com/2018/09/exorcising-the-unemployment-spectre-with-rooftop-solar/), if the government chooses to adopt the decentralised cluster approach with private investment and management.

In spite of this, if the government does not remove the 25% duty, it implies that it protecting the interests of powerful lobbies that want the conventional power grid, power theft, and the desire to continue announcing free power to rural constituents. Thus India’s interests are jettisoned in favour of inefficiency and corruption.

When it comes to streamlining operations, there is unwillingness to set things right. And to bring powerful culprits to book. Consider how a mafia don in Uttar Pradesh was let free by the UP courts because the case related to crimes that happened some 20 years ago. During this period many witnesses had become untraceable, some had died, and some had turned hostile. That’s exactly what happened with the incredible Telgi Scam – which involved printing of bogus Government Stamp Paper and resulted in siphoning out thousands of crores of rupees. Eventually Abdul Karim Telgi died, and the politicians who were behind the scam were let off because of want of evidence. You cannot streamline an economy by letting culprits go scott free.

Streamlining also means reducing the cost of doing business. Ask any entrepreneur. He will tell you of the number of people he has to bribe periodically to ensure that he can continue his life in peace. There is a cost that most people have to pay just to prevent being harassed by the municipal inspectors, the police or the local goon who allows illegal hawkers or stalls to operate in cities. All this adds to the cost of doing business. You can streamline this if the government is willing to encourage whistle blowers. But it has created laws that penalise both the bribe giver and the bribe taker (http://www.asiaconverge.com/2018/08/the-government-protects-bribe-takers/). So why should anyone complain about the bribes paid? Nobody wants to go to prison. And nobody wants to be harassed by overbearing, greasy-palmed officers either.

If India has to become a $5 trillion economy, start with penalising petty corruption. Make the lives of common people easier. Don’t increase fines which are used as an excuse for hiking the bribe quotient.

Unless the costs of doing business are lowered, India cannot easily become a $5 trillion economy.

COMMENTS