INVESTMENT PERSPECTIVE

By J Mulraj

May 8-14, 2022

Biden shoots himself in the foot

A concatenation of events have led up to the current crisis in Ukraine.

A concatenation of events have led up to the current crisis in Ukraine.

Donald Trump never believed he would lose the 2020 Presidential election to Joe Biden evidenced by the tremendous crowds in his publicly held election rallies, cheering wildly, in contradistinction to the pitifully attended (cocooned in vehicles for Covid reasons) rallies of Biden. Well, he did, though he felt, yet did not prove, that the election was stolen.

The Dems felt that they could beat Trump, and selected Biden as their candidate, in the hope that he would, with his years of political experience, be able to guide America through the several headwinds, internally and internationally. Well, Biden did, but has woefully failed to guide America.

This is when the concatenation of events leading up to the Ukraine crisis started.

Biden, in a foolish attempt to erase Trump’s decisions, started off by reversing the policies which had given America its energy independence. Biden heeded the call for climate change, and cancelled, immediately on assuming the Presidency, the Keystone pipeline project, as well as further lease of federal land to companies fracking shale to extract oil, the invention that had made America energy independent.

Interestingly, Black Rock, the world’s largest asset manager, with an AUM of $ 10 trillion, last week that it would vote against more climate change resolutions this year.

At the same time, the ESG (Environment, Social and Governance) norms used by lenders, denied the fossil fuel companies, like ExxonMobile, Chevron and others, the capital to find new oil discoveries. As a result the production of American traditional as well as shale, oil companies is muted and it has not the ability to supply more to Europe to wean it away from Russian dependency.

Biden also failed to lead in a botched withdrawal from Afghanistan, displaying ineptitude, and in engaging, together with NATO, in a dialogue with Putin over his security concerns. He insisted, without having the will to uphold his principles, that Ukraine had the right to seek NATO membership, something that Putin had stated was a red line for Russia. Later NATO admitted that Ukraine would not have qualified for membership, and Ukraine, too stated it did not wish it, but had Biden held talks prior to the invasion and clarified this, perhaps the invasion would have been avoided. A concatenation of events that has led to an avoidable conflict.

The consequences of the Ukraine conflict will stretch much beyond the end of it. These will include a shortage of wheat, leading to food inflation, which will cause famine in parts of Africa, and so to food riots (much like the Arab Springs). As per this article in WSJ planting of crops in Midwest America has been delayed due to weather, as a result of which only 27% of the wheat has been sown so far (compared to 47% last year), 12% of soya (24%) and 22% of corn (50%). India, which had exported wheat earlier, has now banned export of wheat in anticipation of scarcity.

Indian consumers would, perhaps, be cushioned by a sharp hike in prices of wheat and fertilisers, caused by the Ukraine war. At a recent analyst meet of Paradeep Phosphates, the #3 Indian manufacturer of non-urea fertilisers, MD & CEO Narayan Krishnan, stated that the Government, aware of the impact of the war on fertiliser and its input prices, has sought to protect farmers by increasing subsidy on it. The subsidy is paid directly to the farmers under DBT (direct benefit transfer) and the Government has the ability to track each of a billion units transacted! An impressive achievement!

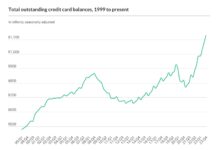

Other than his policies depriving USA of its energy independence, Biden also pursued an excessive fiscal stimulus policy, assisted by an accommodative Federal Reserve which printed money to fund it. This has led to inflation levels, the highest in 4 decades, to combat which the Fed has, belatedly, embarked on an interest rate hike cycle.

Irrationally low interest rates had created several asset bubbles which are now popping, as they are being raised. Excess liquidity had driven up the P/E ratios to unsustainable levels. We are now looking at a time when the E (earnings) will fall, as input costs of everything are rising. Wages are going up, and will do so if inflation remains at over 8%, where it is today; raw materials costs are up; energy costs are rising, and will continue to and finance costs are rising. There is only so much that higher productivity can recompense.

The EU is planning to embargo Russian oil. This is harder to execute than to plan. Germany, for example, is too dependent on it and, as per the CEO of BASF, its small and medium companies would collapse without it. But should it be, theoretically, achievable, it creates a huge problem for Russia and thence, to the world. Russia supplies around 5 m. b/d of oil to Europe produced largely in the Siberian tundra region. If there is no offtake, it would need to stop production once its storage gets full. A stoppage of production in the cold tundra freezes the pipes, to restart which takes years. So, should the embargo succeed, the cure may be worse than the disease, for it would deprive the world of 5 m b/d of crude oil.

Last week the BSE sensex dropped 2038 points to close at 52793.

As per Cullen Roche, the founder of Orcam Financial Group, global stock markets have lost $ 35 t. in market cap. in the last 3 months. This represents 14% of all global wealth. This is the result of the folly of printing money without any responsibility for the future, the madness of the modern monetary theory which believes it is okay to do so.

And now the US Congress has approved a $ 40b. aid package to Ukriane which has been stalled in the Senate by Rand Paul, R-Texas.

The risk is that of Putin, angered by Finland (with which it shares a large border) joining NATO, and poked by supply of more deadly armaments by USA, would, in desperation, resort to the use of tactical nuclear weapons, which he has threatened to. God forbid if such a scenario were to unfold.

Presuming it does not, there would still be a further downside in stock markets due to inflation caused by supply side shocks and also the zero tolerance Covid lockdowns in 14 Chinese cities. China’s GDP growth may drop, worse case, to under 3% in calendar 2022. India’s GDP growth is estimated to be between 7.5- 8%, the highest for any large economy this year, and the next.

So after a further drop, likely, one may consider entering the Indian stock market.

Picture Source: https://www.theonion.com/

COMMENTS