India has big plans and announcements about its INR, but without underlying support

RN Bhaskar

For the past couple of months there have been reports and conjectures that the Indian rupee (INR) could easily become the global reserve currency. The answer to such speculations and plans would be an indulgent smile at the polite level, and a raspberry at the crudest.

For the past couple of months there have been reports and conjectures that the Indian rupee (INR) could easily become the global reserve currency. The answer to such speculations and plans would be an indulgent smile at the polite level, and a raspberry at the crudest.

Such speculation is understandable because of several factors. But, most importantly, the US dollar is slipping. All the data points to this.

Milestones

Just look at the facts that made such comments possible.

- On 14 March 2023, media talked about a statement by the Union minister of state for finance, Bhagwat Kishinrao Karad, that India’s central bank, the Reserve Bank of India, had permitted banks from 18 countries to set up Special Vostro Rupee Accounts (SVBAs) and by approaching the authorised dealer (AD) banks in India for exim deals. Sounded nice (https://www.thehindu.com/news/national/rbi-has-allowed-banks-from-18-countries-to-trade-in-rupee-government-in-rajya-sabha/article66619943.ece)!

- This was preceded by reports in December 2022 that about 30-35 countries, including those from Asia, Scandinavia, and Africa, had expressed interest in better understanding the proposed rupee trade mechanism for possible adoption. Obviously it meant that India was prepared to trade with these countries in Indian rupees (https://www.financialexpress.com/economy/about-35-countries-show-interest-in-rupee-trade-mechanism/2904948/).

- Then, in May 2023, appeared a brilliant report by Ambit Asset Management on “Exploring de-dollarisation in a multi polar world”. The report raises the question about India being prepared for this development, and if the Indian rupee could fill the vacated space.

- A week ago, there was a more direct pitch by Business Today (https://www.businesstoday.in/visualstories/economy/rupee-in-race-to-become-worlds-reserve-currency-watch-us-dollars-dominance-and-decline-in-last-100-years-35492-09-05-2023) stating that the Indian rupee was in the “race to become world’s reserve currency.”

- All these reports came on the heels of high-voltage speculation that the BRICS conglomerate was keen on finding a finding a common currency (https://theexchange.africa/industry-and-trade/brics-countries-keen-on-having-common-currency-toreplace-us-dollar/).

The role of BRICS can be better appreciated if one goes through a recent UNCTAD report (https://unctad.org/system/files/official-document/diae2023d1_en.pdf). It pointed out, that BRICS, as a grouping (including South Africa), has seen a more than fourfold increase in their annual FDI inflows, from $84 billion in 2001 to $355 billion in 2021. Its share in global FDI inflows also doubled from 11 per cent in 2001 to 22 per cent in 2021.

The BRICS grouping comprises Brazil, the Russian Federation, India, China, and South Africa. Today, this group accounts for more than a quarter of global GDP, and 42 per cent of the world’s population. . . . . With regard to trade, BRICS economies represent 18 per cent of global exports.

But it must also be understood that the biggest player in the BRICS grouping is China. This country alone accounted for an 18.2% share of global GDP in 2022 (https://www.worldeconomics.com/Share-of-Global-GDP/China.aspx). Data from China has been given a B grade. India’s share is shown as 8.7%, and its data quality classified as D grade.

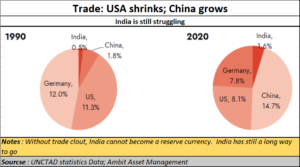

USA continues to top

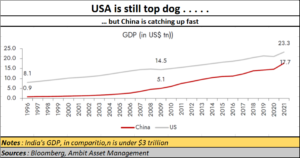

As the charts show, while the US has weakened on the trade front, China has become stronger. While India too has become stronger, it is certainly not in the same league as China.

But this is not to dismiss the US right away. It is easily the biggest player still on the global map. It is top dog!

But this is not to dismiss the US right away. It is easily the biggest player still on the global map. It is top dog!

Yet, as the Ambit report points out, “Today, the U.S. economy is showing signs of slowing down, with other economies – especially China and India – catching up fast.

Additionally, increased trade wars and sanctions by US have accentuated the search for a new trade mechanism other than US Dollar. This has only accelerated over the last year since the Russia-Ukraine conflict, thus giving wind to the de-dollarisation thesis.”

Ambit goes on to explain that de-dollarisation refers to countries reducing reliance on the U.S. dollar as a reserve currency, medium of exchange or as a unit of account. It is a process of substituting US dollar as a primary currency used for:

- Trading oil and/ or other commodities (i.e., petrodollar),

- Buying US dollars for the forex reserves, and

- Bilateral trade agreements

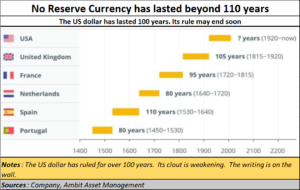

The eventual collapse of the dollar was predicted almost a decade ago, based on historical evidence of currency cycles. The increase in US deb after 2008 only added to such dire prognostications.

Self inflicted wounds

But the final blow appears to have come from the short-sighted moves of both the US and  the EU. Had the latter exercised a bit of sobriety, this crisis could have been avoided, and the EU too would not be forced down to its knees (https://www.youtube.com/watch?v=k_uyfb6OyZ8).

the EU. Had the latter exercised a bit of sobriety, this crisis could have been avoided, and the EU too would not be forced down to its knees (https://www.youtube.com/watch?v=k_uyfb6OyZ8).

Of course, there have been justifications for the combined moves against Russia in favour of Ukraine. “It is a violation of international rules. It is a violation of sovereignty,” echo spokespersons for the EU, NATO, UK and the US.

These are lofty sounding phrases indeed. But where were these words when the US invaded Iraq and used degraded uranium – which is classified as a weapon on mass destruction? Where were these fanciful phrases when the US and its “lapdog” UK (as lampooned by the British media), allowed the bombing and strafing of Syria and then Libya. Not a voice protested when the US invaded Afghanistan. Not a squeak from the countries that tried to take the high moral ground when regimes were toppled, and political leaders were assassinated (https://asiaconverge.com/2022/02/ukraine-the-war-that-usa-wants/). It was clear that the war was being waged with principles only as a fig leaf for geopolitical reasons aimed at weakening both Russia and China. A Zelensky is now being sought out in India as well.

As a result, the Euro which could have become the global reserve currency will now stay pummelled to a fraction of its earlier strength. A short-term victor is the US, which has been able to sell more arms than ever before, and more oil and gas to the flailing EU.

But the victories are short term. The impounding of assets and money belonging to countries like Afghanistan and Russia has only convinced skittish money-managers to find a parking place other than the US dollar. Almost everyone is trying to seek out a new system for trade – away from the US owned SWIFT, and away from the dollar.

India’s moves

India is now negotiating rupee trade with more countries than ever before. China achieved a coup of sorts when it got Saudi Arabia to sell it oil in CNY (the Chinese Renminbi).

India is now negotiating rupee trade with more countries than ever before. China achieved a coup of sorts when it got Saudi Arabia to sell it oil in CNY (the Chinese Renminbi).

India could have had a good chance but for three factors:

- Its GDP is dwarfed by China.

- Its share of global trade is too small compared to China.

- Its weakening exports, yawping trade deficit (https://asiaconverge.com/2023/04/indias-confused-exim-strategy/), and the weakening rupee, will make the INR less attractive as a reserve currency. Nobody likes a weakening currency. China’s currency is more stable than the INR. India’s attempt to put a 20% tax on outward remittances underscores its own skittishness about the flight of the rupee or of foreign exchange (https://www.business-standard.com/budget/article/budget-2023-understanding-20-tcs-on-foreign-remittance-transactions-123020200940_1.html).

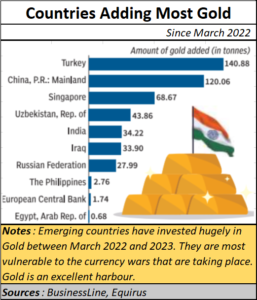

But the fierce winds from currency wars threaten to rock emerging economies. That could explain why central banks from such countries have begun investing in gold. In gold we trust, they seem to be saying.

Capital controls

To become a reserve currency, you need to have no, or very light, capital controls. India cannot afford it.

Nor can China, but it is working its way towards easing capital controls with its CBDC and by entering a new SWIFT. It has just unveiled a financial payment connectivity. This was achieved by linking Russia’s System for Transfer of Financial Messages (SPFS) with  Iran’s local interbank telecom system (SEPAM), suggesting that the two systems had been developed with technical connectivity in mind. The Shahr Bank of Iran and Russia’s VTB Bank will be heading up the initial pilot program, while other lenders will come on board once the pilot works through any bugs which might arise (https://www.silkroadbriefing.com/news/2023/01/31/has-russia-and-irans-financial-messaging-link-up-sped-up-the-demise-of-swift-and-ushered-in-a-global-payments-revolution/). This was a big development over what was predicted a year ago.

Iran’s local interbank telecom system (SEPAM), suggesting that the two systems had been developed with technical connectivity in mind. The Shahr Bank of Iran and Russia’s VTB Bank will be heading up the initial pilot program, while other lenders will come on board once the pilot works through any bugs which might arise (https://www.silkroadbriefing.com/news/2023/01/31/has-russia-and-irans-financial-messaging-link-up-sped-up-the-demise-of-swift-and-ushered-in-a-global-payments-revolution/). This was a big development over what was predicted a year ago.

As for India, it needs to look beyond the hype around its Aadhaar and the UPI. Unless the glitches in the basic Aadhaar system, and NPCI’s the refusal to keep logs of transactions, are overcome, it will be pushing a lame solution. None of the major foreign banks have bothered to touch the Indian banking software, Finacle (https://studydhaba.com/software-used-by-different-banks/). Do recall that it was this software that allowed transactions to be done without logging them into the central registry – something no banking software should ever allow. This is what made the Nirav Modi scam possible (https://asiaconverge.com/2018/02/pnb-why-did-the-dogs-not-bark/).

Rising global tensions, trade wars and financial / economic sanctions have compelled countries to look for alternative form of payment / settlement other than USD. Russia is leading the de-dollarisation campaign from the frontline with support from China, Iran, and economies in Latin America. Russia has already offloaded $80 bn in US securities. US dollar hegemony has been a frequent target of criticism by the Chinese government in recent years, with the US-China trade war plunging bilateral relations to a decades-low point, and the ongoing tech-decoupling endeavours of the Biden administration have raised concerns of an all-out clash. The impact of US sanctions on Russia is demonstrating how much influence the US wields over a dollar-driven world, inspiring many countries to speed up their search for options.

De-dollarisation

As the Ambit report points out, there are signs that de-dollarisation is catching up in other parts of the world:

- Russia – is trying to make payments in non-dollar currencies for bilateral trade and has been transferring dollar holdings to the Russian jurisdiction. Even pre-war, the use of USD in Russia’s exports to BRICs nations crashed from ~95% in 2013 to <10% in 2020.

- China has a de-dollarisation agenda has a parallel track in promoting own currency yuan as the alternative to the dollar in international trade and investment. The Special Drawing Rights achieved by Yuan in 2016 is a case in point. China is avoiding US dollar-based transactions in bilateral trade. It has done so with Iran and agreements were signed with Saudi Arabia, Canada, and Qatar to that effect.

- Alternative for SWIFT – Efforts are underway for the possible introduction of a new Russia-China payment system, bypassing SWIFT and combining the Russian SPFS (System for Transfer of Financial Messages) with the Chinese CIPS (Cross-Border Interbank Payment System).

- India – RBI has allowed International Trade Settlement in Indian Rupees (INR) to facilitate trade with partners. Apart from these about 35 nations have expressed an interest in learning more about how the rupee trade mechanism works.

- Increasing talks of a BRICS currency – India, Russia and China are spearheading talks of development of a new currency which can be used for cross-border trade by these BRICS nations.

India still has a whisker of a chance. But it must first set its own house in order.

COMMENTS