Global growth requires much more than GDP and population

By RN Bhaskar

On 9 December, 2023, a senior minister of the Indian government spoke at an industry forum. He exhorted industrialists in the audience to collaborate further with the Government to make the 21st century India’s century (https://pib.gov.in/PressReleasePage.aspx?PRID=1984385). He also said that, as a global growth engine, India is providing a new direction to the world. Really?

Names are not important here, because the minister was mouthing phrases almost every government functionary has learnt to echo. Somehow, it reminds one of a little boy trying to show off his muscles, believing that he could be a Superman. And indulgent adults cheer him on.

Size is crucial to be a global growth engine

Size is crucial to be a global growth engine

India may have its aspirations to be big, but two of the very few claims that India can boast of for the next few years are GDP and population. In fact, it is because of India’s large population that ratcheting up a huge GDP becomes a-not-so-difficult task. As these columns have often pointed out, even Rs.10 contributed by each Indian towards taxes (GST is a tax that is mostly unavoidable – even government grants help push up GST collections — because it is an indirect tax on almost all goods and services) allows the central exchequer to show Rs.14 billion each year as its collections.

A better test would be per capita GDP, where Bangladesh has been doing rather well – even better than India. This is even though it has a population density that its at least four times greater than India’s. A higher population density automatically divides the GDP by more people. Yet, despite this handicap, Bangladesh has just surpassed India’s levels.

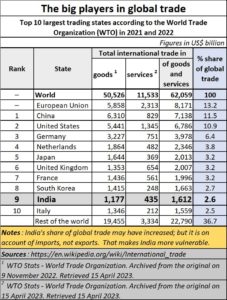

Another way to determine if a country could be a driver for global growth, is by looking it his share of global trade. This is where India fares rather poorly.

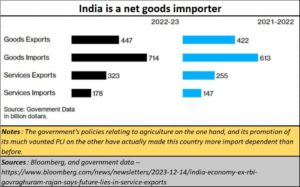

True, the country’s share of global trade has gone up from 1.97% in 2010 to 3.97% in 2022. But much of this growth is because of a surge in imports. And in the recent past, much of the import surge has been on account of the government’s focus on capital intensive industries, instead of labour intensive ones (free subscription — https://bhaskarr.substack.com/p/dont-shun-market-allocation-of-resources?sd=pf).

This is what the former governor of the Reserve Bank of India (RBI) has also been saying. He articulated this even more eloquently in recent media interviews (https://www.bloomberg.com/news/newsletters/2023-12-14/india-economy-ex-rbi-govraghuram-rajan-says-future-lies-in-service-exports) when he along with Rohit Lamba (an economist at Pennsylvania State University) made a pitch for growth led by services.

Rajan points out how India “remains a net importer of goods as it ships in components to assemble locally. Other sectors under the incentive program have yet to take off. Meanwhile, net service exports were up 34% in fiscal 2022-23.”

Rajan points out how India “remains a net importer of goods as it ships in components to assemble locally. Other sectors under the incentive program have yet to take off. Meanwhile, net service exports were up 34% in fiscal 2022-23.”

He says that India needs to get away from history – “The world has changed. We have enabled a whole new set of activities which Japan never had, China never had, but we have. Let’s recognize that and not go back to a model which is historical (just) because that seems to be the only model.”

What has increased India’s vulnerability is its step motherly treatment to the agricultural sector. Year after year, the government has favoured importing high value crops like edible oil (https://asiaconverge.com/2022/01/the-government-lets-down-indias-edible-oil-industry/) rather than creating policies that would reward farmers if they focussed on augmenting domestic growth. Currently such imports have peaked (https://economictimes.indiatimes.com/small-biz/trade/exports/insights/indias-record-import-of-edible-oil-is-drowning-local-producers/articleshow/106010009.cms)

Similarly, instead of promoting a time-tested model developed by Verghese Kurien, the government has done much to hurt the milk industry. Kurien, it may be remembered, made India self-sufficient in milk production without any subsidy from the government (https://asiaconverge.com/2023/01/sodhis-resignation-has-dire-warnings-for-agriculture-and-milk/). Yet, to win political advantage, the government allowed the introduction of subsidies for an industry that had growth without them. In doing so, the government is promoting sickness in a sector that has been vibrant for the past five decades, if not longer.

The government’s reluctance to promote the leather industry, and beef export are two other instances of ideology being allowed to dictate a country’s competitive advantage.

Not surprisingly, the states which are the most aggressive in creating barriers to such trades are among the poorest of the states in the country. As a media report points out, just four states account for almost 70% of tax collections in the country (https://indianexpress.com/article/business/economy/four-states-drive-70-of-net-direct-tax-mop-up-in-fy23-9056117/). These four states — Maharashtra, Delhi, Gujarat and Tamil Nadu – are not among those that have promoted frenzied attacks against the leather and beef trades.

At the same time, the government has banned futures in the largest number of commodities in the recent past (https://asiaconverge.com/2022/10/the-folly-of-banning-futures-trading-in-commodities/). Thus, instead of letting farmers discover prices and grow crops guided by futures prices, the government has made them more dependent on government doles and subsidies. The farmer is, thus, less self-reliant than he was in the past. However, doles and subsidies make the government appear more like a saviour, which works quite well at the hustings. Yet, what may be good politics is disastrous economics.

Listen to V Vaidyanathan, MD and CEO, IDFC First Bank (https://www.businesstoday.in/industry/banks/story/bt500-tragic-to-see-rural-india-is-most-under-financed-says-idfc-first-bank-md-ceo-v-vaidyanathan-409360-2023-12-13). Speaking at the BT 500 Wealth Creators Summit he pointed out that “”Agri is phenomenal. I find it rather tragic to see that when we go to rural market these days…and it has been 75 years of India’s independence, even now we find, it is completely unfunded,”

Then consider the recent bans on the export of rice, wheat, sugar, and onion, and you can see how poorly the government has planned for agriculture to become both vibrant and self-sustaining.

The consequences of such sins of both omission and commission will be a burden that farmers and the whole of India will have to bear. This is also because the rural sector accounts for almost 60% of India’s population. Any reduction of rural-purchasing-power, invariably ends up slowing down industrial output, and increases income inequality in the country (https://asiaconverge.com/2022/08/rural-markets-will-decide-indias-revival/).

To be a growth driver, you need heft. Much of the heft comes from being a big global player in trade and commerce. Unfortunately, the government’s policies for both industry and agriculture have succeeded in diminishing India’s role in the world.

Not surprisingly, despite India accounting for the third or fourth largest GDP in the world, it is ninth in the pecking order of global traders. If India has to improve its ranking, it mut focus more on labour intensive businesses, and less on capital intensive trades. The government must curb its penchant for directing the allocation of capital (free subscription — https://bhaskarr.substack.com/p/dont-shun-market-allocation-of-resources?sd=pf). It must trust the savvy of businessmen instead.

It must also refocus its attention on making India more investor and business friendly. Without such measures, more Indian businessmen will continue to leave India’s shores (free subscription — https://bhaskarrn.substack.com/p/earlier-it-was-diamonds-will-it-now?sd=pf).

And it must curb its enthusiastic chest thumping — claiming to be much bigger than it really is.

COMMENTS