Policy lapses could revive the 1990 spectre once again

By RN Bhaskar and Sakeena Bari Sayyed

Image sourced through Copilot

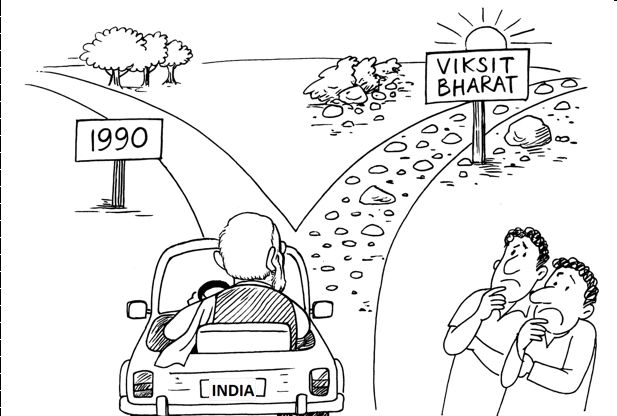

India is at the proverbial fork. There is a road, full of obstacles, which could lead to Viksit Bharat (the mirage politicians have created). The other road, half hidden by trees, is inviting, smooth. It is the road that leads to 1990.

1990 was when India had no money left in its reserves. It led to India mortgaging its gold to finance its imports. It had a license raj economy; key items were always in short supply. Telephones, fuel, coal, even electricity. Unemployment was causing public unrest. Fortunately, India got a prime minister like P.V. Narsimha Rao who along with Dr. Manmohan Singh (as finance minister) abolished much of the license raj and opened the windows to let some economic fresh air drive away old practices. Had this not happened, India would have been reduced to a failed state.

Unfortunately, things have come to a pass where India has to choose, once again. Present indications suggest that the driver will take the easy and comfortable ride that leads the nation back to 1990. The tough decisions which often require vision, grit and political will are being shelved. Populist and (electorally desirable) divisive policies, have riven the entire population. The majority urges the driver to take the smoother road.

The rest of the nation watches this with bated breath. India’s year of reckoning has arrived. 1990 is just round the corner.

Reviving the License Raj

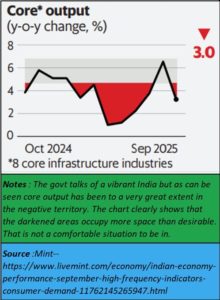

As is often described by analysts, India continues to be a land of opposites, of contradictions. But these contradictions become absurd if you juxtapose government pronouncements with hard economic data. It is hard to reconcile both. In fact, the measures that the government has taken, by and large, suggest that it will propel India back to 1990.

The licence raj was largely abolished in 1990. But it has begun to raise its head in other ways. The army of rent-seekers has become larger. Its appetite even more voracious than before. In many cases, officials want to collect fees as bribes, failing which the official could make life miserable for the taxpayer. The modifications in the Prevention of Corruption Act (https://asiaconverge.com/2018/08/amendments-to-prevention-of-corruption-act-protect-corruption/), ensure that, in most cases, complaints do not get registered.

This is true with

- the shops and establishment inspectors (https://asiaconverge.com/2016/12/want-to-uproot-corruption/),

- the traffic police (https://asiaconverge.com/2024/08/mumbais-traffic-police-has-huge-gaps-in-its-service-delivery/) near every traffic signal,

- food inspectors (https://youtu.be/ghnkyQEdp64?si=5ikXr1vCvxzcxiYx)

- drug inspector (https://asiaconverge.com/2025/10/cough-syrup-deaths-indias-drug-authorities-abet-murder/).

- Road and bridge inspectors (free subscription — https://bhaskarr.substack.com/p/a-bridge-too-far?utm_source=publication-search)

- The list goes on.

Effectively, the common person is squeezed from all sides. Expectedly, his productivity slows down.

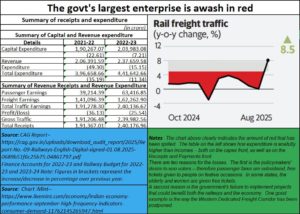

The Indian railways could easily be one of the largest enterprises in India. It spans the entire country, employs around 1.3 million people. This number could become larger if the political promises made in Bihar and Uttar Pradesh, about the government creating more jobs, actually materialize (https://www.thehindu.com/elections/bihar-assembly/bihar-elections-2025-what-are-parties-promising-in-theirmanifestos/article70225974.ece).

But the railways is bleeding. It makes losses year after year. There are some noticeable exceptions – especially when Lalu Prasad Yadav was a railway minister – when the railways were profitable.

Why did the railway start losing money? There are three reasons.

1) Administrative inefficiency.

2)Political largesse either as free tickets or subsidized fares or the creation of more jobs in electorally important states like Bihar and Uttar Pradesh.

3) Myopic planning.

The first cause is what leads to train accidents, deaths on the tracks and poorly maintained facilities.

The second cause is where the government officially allows ticketless travel. In some states like Uttar Pradesh and Bihar, few ticket checkers would dare demand fines from ticketless travellers. In Maharashtra, backward classes are allowed to travel free of cost in trains on Ambedkar Jayanti. In some states women and children are allowed concessional or free train travel. Such largesse, effectively, translates into lower revenues for the railways, creation of more political lobbies which misuse the railways and even damage properties and create vested interest groups clamouring for even more freebies.

The third cause refers to policy blunders like the promotion of the Haryana-West Bengal Freight Corridor (known as the Eastern Dedicated Freight Corridor (DFC)). It also refers to the postponement of the Western DFC (https://bhaskarr.substack.com/p/indias-two-dfcs-politics-trounces?utm_source=publication-search). The latter could have created significant revenues for the railways. The Western DFC would also have helped the Indian industry to reduce logistics costs, thus become globally competitive. Similarly, the government’s decision to promote a high-speed train between Mumbai and Ahmedabad might prove to be a white elephant adding to the woes of the railways.

Together, all the three causes described above add to the expenditure outlay of the government of India. In turn, this pushes up the tax burden for the average taxpayer. The end result: a weakening Indian economy (https://bhaskarr.substack.com/p/countries-and-currencies-viksit-bharat?utm_source=publication-search).

Evidence of weakness

Signs of a weakening Indian economy can be found in great abundance. Listed below are some of the key findings.

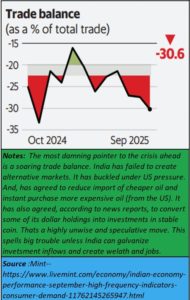

A myopic view of trade, made India scrap over three dozen BITs (Bilateral Investment Treaties) in 2016 (https://asiaconverge.com/2020/01/arbitration-and-investment-protection/). That decision coupled with the worsening license raj shooed away investments that should have come to India. An inspector raj culture frightened Indian businessmen away as well. As a result, inbound FDI declined and Indian promoters began pushing their money overseas. By August 2025, India had a negative net FDI position. Another reason was that India’s imports became larger than its exports.

As one media outlet (https://economictimes.indiatimes.com/news/economy/finance/net-fdi-turns-negative-in-august-as-outflows-fpi-selling-rise/articleshow/124709719.cms?from=mdr) put it, gross foreign direct investment (FDI) into India fell to $6.0 billion in August after surging to over a four-year high of $11.11 billion in July. This, along with a 30% month-on-month rise in repatriation by foreign companies to $4.9 billion, led to the net FDI number for August turning negative for the first time in the current fiscal year.

Add to these numbers the absence of a decent number of toilets, and an increasing dependence on paramilitary forces to stomp out any murmurs of protest. This is exacerbated by the government’s inability to create more jobs on the one hand and the march of technology which will slash existing jobs on the other.

The government has not yet got its act together by creating new policies which would allow the creation of new enterprises, hence new jobs. Education, that could have helped its population migrate easily towards new skills is largely in a state of morass (free subscription — https://bhaskarr.substack.com/p/the-state-of-education-in-india?utm_source=publication-search). And the slippage in rankings of even its best institutes of higher learning is a pointer to the deteriorating situation (https://www.business-standard.com/india-news/india-loses-top-spot-to-china-qs-asia-university-rankings-2026-125110401855_1.html).

Cumulatively, all these pointed to an environment that is not conducive to fresh investments. This needs to change if India must prosper.

The best indicator of how India is hurtling towards 1990 can be found in the import cover chart. This is a number which tells you how many months of imports can be sustained by the existing levels of forex reserves.

Watch the chart above. Import cover declined last year and at present it is just near the border line – just enough for one year’s imports. It reminds you of the time when India did not have money to pay for its import. That was when it had to pledge its gold to get emergency funds to finance imports.

So why is import cover so poor? It is poor because India has forgotten how to export. It has failed to create new markets outside the traditional West. In ancient times, India traded with both the East and the West and excelled in such trade (https://www.youtube.com/watch?v=ibJJXeGyZxA). It has ignored the rapidly growing populations of Malaysia, Indonesia, and a host of African countries.

Even now India prefers to send its trade ambassadors to faraway places like Peru instead of developing neighbourhood markets. There are vested interests in the government pushing for New Zealand, when they should be pushing for Indonesia and Malaysia instead. For the first time, even Niti Aayog has advised India’s policy makers on the need to develop neighbourhood markets (https://www.financialexpress.com/business/industry-niti-aayog-chief-stresses-need-for-strong-arrangements-with-neighbors-including-china-4001493/).

There is a second problem. India has not cared to produce the goods that its key friendly countries require. A good example is Russia. It has a huge trade balance against India which it would like to reduce if only India could produce the goods that Russia needs. Even after several decades of trade with Russia, India has not learnt this art.

Expect the interest cover to get worse. India has just capitulated to the US demand that it stops importing (significantly cheaper) Russian oil. It has committed to purchase (more expensive) US oil. That will push up its import bill.

Compounding this is the fact that India remains import intensive. It needs Chinese APIs to export its pharma products. It needs electronic components from China to facilitate its electronics exports.

At the same time India’s Sinophobia has prevented it from working with China to take up industries where China’s labour cost has climbed. A good example is garment exports where China was the global leader. As labour costs in that country climbed, India could have picked up some of China’s markets by entering into joint ventures with that country. India’s reluctance to do this became Advantage Vietnam (https://bhaskarr.substack.com/p/is-india-spooked-by-china?), It also benefitted the Philippines and even Bangladesh. Consequently, Chinese joint ventures in textiles and garments moved to those countries. Even Bangladesh made policy changes that helped it grow and which India failed to learn from (https://asiaconverge.com/2022/05/bangladesh-trounces-india/).

India was short-sighted enough to ban Chinese investment in Indian startups. A decade ago most Indian unicorns became profitable and large (https://asiaconverge.com/2020/03/china-investments-in-india-are-strategic-and-profitable/) because of patient yet savvy investment from China. The move hurt India more than it did its larger neighbour. It also hurt employment.

Overall, instead of cultivating neighbourhood markets India was left friendless (https://asiaconverge.com/2025/05/india-is-losing-friends-influence-and-money/).

As mentioned above, India’s capitulation to the US demand to stop purchasing (cheaper) Russian oil, will mean a significant increase in its negative trade balance. Expect the rupee to become weaker soon.

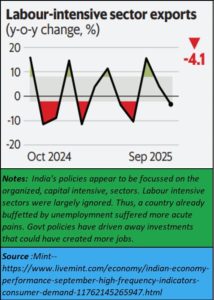

The inability to attract investments — both domestic and foreign — led to the non-formation of new enterprises which could create jobs. Instead of focussing on labour intensive industries, India chose to invest more in capital intensive sectors. All this has resulted in huge cash outgoes. This has left India more vulnerable.

The inability to attract investments — both domestic and foreign — led to the non-formation of new enterprises which could create jobs. Instead of focussing on labour intensive industries, India chose to invest more in capital intensive sectors. All this has resulted in huge cash outgoes. This has left India more vulnerable.

Unemployment and poorly thought-out agricultural policies (https://asiaconverge.com/2025/03/dairy-ruminations-that-make-little-sense/) combined to reduce consumer demand and kill purchasing power. That has made existing industries weaker. The focus on subsidies and doles taught people to forget how to work to earn a living. The irony was that the poor got the doles, while the rich had enough money. That squeezed the middle class and further reduced purchasing power (https://bhaskarr.substack.com/p/the-shrinking-growth-of-the-middle).

Hopefully, India will fast-track investments from China, which will create more employment and wealth. But vested interests frown at such moves. And Indian policymakers are too wedded to US interests to push this with the urgency required.

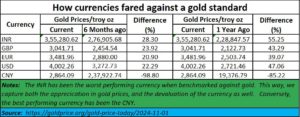

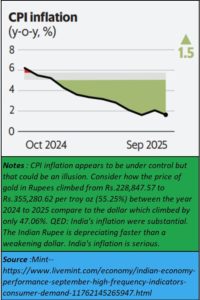

If one goes by charts based on government data, inflation appears to have been tamed. But consider another indictor. Just look at gold.

When you look at gold prices it makes sense to consider how they soared in different markets. Watch how the increase in prices has been the highest for India and lowest for China. These prices capture both the surge in the value of gold as well as local inflation. It then becomes clear that inflation has not really been tamed. In fact, the rupee has weakened even against a weakening dollar. The surge in imports, the growing trade deficit and the lack of employment will together combine to further whittle down purchasing power.

When you look at gold prices it makes sense to consider how they soared in different markets. Watch how the increase in prices has been the highest for India and lowest for China. These prices capture both the surge in the value of gold as well as local inflation. It then becomes clear that inflation has not really been tamed. In fact, the rupee has weakened even against a weakening dollar. The surge in imports, the growing trade deficit and the lack of employment will together combine to further whittle down purchasing power.

Unemployment and poverty are sure fire trigger for social unrest. The divisive language of political leader will only polarize this angle and create further unrest.

Conclusion:

If India has to be saved, it must be through investments, employment, exports, and social harmony. Any deviation from these goals will push India back to 1990. That must be avoided.

===============

Do view my latest podcast on the dangerous policies on the declining fortunes of Isreal, US and Ukraine, and why US desperately needs to raise money through tariffs. You can find it at https://youtu.be/zoQZzLkN5qY

———————–

And do watch our weekly “News Behind the News” podcasts, streamed ‘live’ every Saturday morning, at 8:15 am IST. The latest can be found at https://www.youtube.com/live/WNgKJC8cEp8?si=ZpuLrDc9tem9yLYl

===================

COMMENTS