Picture source https://www.canva.com

Only jobs and good education can end the desperate times for the poor in India

RN Bhaskar

Before we get to the article on desperate times, there are two items on the agenda.

First, Festive greetings. My greetings can be downloaded from https://asiaconverge.com/wp-content/uploads/2024/12/2024-12_Greetings_Cherished-moments.jpg

Second, a tearful farewell to Dr. Manmohan Singh, former prime minister of India (https://en.wikipedia.org/wiki/Manmohan_Singh ). He, along with Narasimha Rao, helped India get on to the road to prosperity. Currently the country is in grave danger of slipping off this road (free subscription — https://bhaskarr.substack.com/p/did-someone-say-viksit-bharat).

Today, there is an ill wind blowing through India. As a publication pointed out, The BJP’s slim victory at the centre was followed by a disastrous performance on the economic front.

Bad omens

GDP fell. Horrifyingly. That left even constantly trumpeting leaders tongue tied. At least briefly. The only lame response is that the next quarter will be better. Meanwhile some ministers have already begun witch-hunting. Some of them have begun putting the blame on the RBI’s policies for the fall in GDP growth (https://www.business-standard.com/economy/news/gdp-growth-h2-fy25-economy-india-finance-ministry-rbi-policy-demand-124122600750_1.html).

Witch-hunts have become increasingly common. First the target was the opposition parties. Then it was scamsters who ran away from India. Then came the turn on financiers who arranged funds for opposition parties. Now it is the RBI itself. Charming development. The fact is that government policies were to blame. It failed to look at three opportunities it could have grabbed and changed course (free subscription — https://bhaskarr.substack.com/p/india-spurns-its-advantages)

Rural populations have begun growing. That suggests that many, who have farm-owning relatives and friends, have opted to go to rural areas instead of starving and begging in in towns and cities. Purchasing power has plummeted making many people cashless and desperate. This can be seen through the surge in gold loans and the increasing defaults in credit card payments.

Another knee jerk reaction of the government has been to insist on a reduction in lending rates (https://bhaskarr.substack.com/p/why-are-interest-rates-high). That is an unwise suggestion. If it is followed, expect the equivalence of fat on a blazing economic fire. The rupee could weaken a lot more. It is already at its lowest, but could go significantly lower, if common sense about the way money supply works does not prevail.

As some experts point out, India has a window of opportunity for just 20 more years to claw itself out of the mess it is in. After that it may be too late (https://www.india.com/business/india-has-20-years-after-that-it-will-not-get-the-chance-why-did-world-bank-expert-say-this-indermit-gill-make-indian-economy-robust-7495452/).

Meanwhile, the nation continues to be rattled by frenzied chants from crazed person screaming “jai Shri Ram” and hunting for more mosques to be put under the microscope to find out if they were Hindu shrines earlier. Obviously, when desperate times begin to gnaw at government strings, distracting the masses with cries of Jai Shri Ram, and temple treasure hunts is a good strategy.

The only problem is that, invariably, rent-on-hire crowds get their daily doles. The rest of India loses more jobs, more investments, more foreign tourists and even the ability to set the economy right. The solution lies in better economic policies including jobs, education, and a friendlier business climate.

A deeper delve into some of the burning issues is therefore needed.

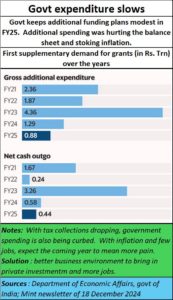

GDP growth fell because of two reasons. First is the fall in investments, both private and government. Private investments fell because of a not-too conducive economic environment. Government investments fell because it has little money left.

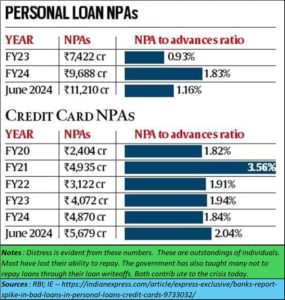

The second reason was inflation, and the loss of jobs caused many families to go broke. That in turn led to defaults on personal loans and on credit cards.

The second reason was inflation, and the loss of jobs caused many families to go broke. That in turn led to defaults on personal loans and on credit cards.

When jobs are unavailable, and investments decline, GDP growth will fall.

When jobs are unavailable, and investments decline, GDP growth will fall.

Desperate families even began pawning their gold. The exact data on defaults on gold loans is not available as yet. But oral anecdotes suggest that gold loan defaults are also swelling.

As a media report put it, “The increasing allure of Buy Now, Pay Later (BNPL) schemes and easy e-commerce instalment purchases is propelling young millennials into a credit card debt spiral . . . . . According to data from TransUnion Cibil, credit card defaults have risen from 1.6 per cent in March 2023 to 1.8 per cent by June 2024. Although this may seem marginal, the amount of outstanding credit card dues has skyrocketed to nearly Rs 2.7 trillion by June 2024, compared to Rs 2.6 trillion in March 2024 and just over Rs 2 trillion in March 2023, (https://www.business-standard.com/industry/news/millennials-fuel-surge-in-credit-card-defaults-as-e-commerce-drives-debt-124092600854_1.html)

Another media report pointed out that “As of June 2024, credit card outstanding amounted to nearly Rs 2.7 lakh crore, up from Rs 2.6 lakh crore in March 2024 and a little over Rs 2 lakh crore in March 2023. Before the pandemic, in March 2019, total card outstanding stood at Rs 87,686 crore – representing a CAGR of 24% over the five-year period. (https://timesofindia.indiatimes.com/business/india-business/credit-card-dues-defaults-on-the-rise/articleshow/113680910.cms).

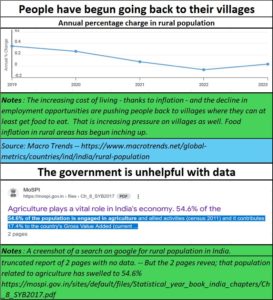

Not surprisingly, a reverse flow of populations has begun.

Not much data is available from government sources, but databases like Macro Trends (https://www.macrotrends.net/global-metrics/countries/ind/india/rural-population) show that the percentages of people in rural areas is increasing. The fears of urbanisation are being pushed back.

Normally, a reversal of urbanisation would be a good thing. It would reduce pressure on urban infrastructure. But this time, it is a clear sign of distress.

People are beginning to find the cost-of-living rise in urban areas, to the point of being unaffordable. That could explain the surge in gold loans, and the defaults on credit card dues.

People are beginning to find the cost-of-living rise in urban areas, to the point of being unaffordable. That could explain the surge in gold loans, and the defaults on credit card dues.

As a PWC report points out (Striking Gold – “The rise of India’s gold loan market” Aug 2024 — https://www.pwc.in/assets/pdfs/striking-gold-rise-indias-gold-loan-market.pdf), “India was the world’s second-largest consumer of gold in 2023 [the largest was China]. . . . . The demand for gold jewellery specifically experienced a year-on-year decline of 6%, totalling 562.3 tonnes in 2023 . . . .The overall demand for gold in India amounted to 747 tonnes in 2023, reflecting a 3% decrease compared to the previous year.” The report attributes this decline to high prices.

Yet a 15% CAGR surge in gold loans tells another story.

The key cause for the reduced demand for gold could be rural impoverishment. The rural sector is the key creator of demand for gold. It is linked to faith, confidence in the metal, and custom (religious ceremonies across communities advocate the use of gold). People seldom part with their gold, except when gifting it to very close relatives (especially to daughters at the time of weddings). The surge in gold loans underscores the distress in people. They have been left with little option but to pawn their gold.

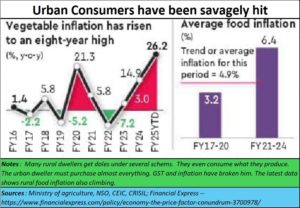

And when that gold too is close to getting over, many go back to their villages. Sadly, food inflation is now hurting rural areas more than urban areas (https://indianexpress.com/article/explained/explained-economics/explainspeaking-food-inflation-hits-rural-india-urban-areas-9647219/).

Food inflation is also playing havoc with the FMCG sector (https://www.business-standard.com/economy/news/food-inflation-continues-to-play-spoilsport-for-fmcg-sector-kantar-report-124122300894_1.html). Not surprisingly, the government wants new inflation indices created without including the food sector. That is laughable, because the lower middle class – the largest segment of India’s population, spends almost 80% of its income on food.

The neglect of the rural sector

The neglect of the rural sector

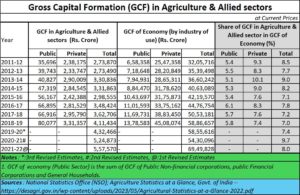

Even a migration to the villages would not been bad, had agriculture value-added increased. But the government has focussed more on doles and freebies for the rural sector, instead of teaching it to become self-reliant and prosperous. Doles, as repeated columns by this author have pointed out, teach a person not to work. It eventually destroys both work ethics and the sector itself.

The absence of any focus on actual development in farming practices, including food processing and supply chains, explains why gross capital formation averages – over a five-year period — in agriculture have declined compared to the five years beginning 2011-2012.

Agriculture was badly savaged first by the senseless cattle slaughter laws (https://asiaconverge.com/2023/01/sodhis-resignation-has-dire-warnings-for-agriculture-and-milk/) and then by demonetisation (https://asiaconverge.com/2017/01/demonetisation-has-made-govt-richer-people-poorer/). And now, with little investment in agriculture, the current policies of the government are hurting rural folk and micro industries once again.

So, what is the solution?

As mentioned right at the beginning of this article, India has a mere 20-year period to have a chance to stand up tall among developed nations.

But to get there it must do five things:

- Improve the business and investment climate. The country needs fewer raids, and arrests without warrants or explanations which the repugnant PMLA allows.

- Mend fences with more Islamic countries. India has been shrill in its anti-Islam rhetoric – at least at the ground level, fuelled by agencies known to be close to the government. But the global tide is changing rapidly. India will need the goodwill from the Middle East countries and a resurgent Iran, as they become more powerful voices in the rapidly emerging BRICS (https://bhaskarr.substack.com/p/india-china-and-russia-could-be-dancing). With the Western empire weakening, much of the trade will have to move to the Middle East and the East. Countries like Malaysia and Indonesia have large Islamic populations who must be wooed with Indian products. India will have to change course. Else it will be Advantage China.

- Focus on farm atma-nirbharta. This was meant to be self-reliance. But India has cozied up to countries like Canada, Thailand, Malaysia and Myanmar for the import of pulses and edible oil. That needs to change. Instead, India must pay its own farmers higher prices. Announce these prices (like an MSP or minimum support price) right away so that farmers increase acreage of such crops. That will make Indian farms richer, and will also improve our balance of payments. It will allow the rupee to become stronger, and inflation to be contained. Do the same with milk. Follow the policies of Verghese Kurien and do not allow the import of milk and milk products. Never forget that, for India, milk is more important to India than rice and wheat are. It accounts for a larger share in India’s GDP that both the cereals together. It is the mainstay of the rural population.

- Speed up investments from China. Beware the siren songs of the West, and that includes Israel. Do remember that the largest number of startups in India came up because of investments from China (https://asiaconverge.com/2020/03/china-investments-in-india-are-strategic-and-profitable/). This will help India achieve four objectives. First, it will speed up normalisation processes with its largest neighbours. That in turn could allow some money to be spent on the economy, instead of the army. Second, it allows for the generation of wealth. The Western empire is declining. It will have little to offer by way of investments. China is the country that can invest. Third, more startups will mean more money for both Indian entrepreneurs, and for people who get jobs. There is a fourth benefit. Investments in enterprises can be used to offset the adverse trade balance. This must be done immediately.

- Modify tax laws. Make life easier for Indians especially the poor and the middle class. If possible, even abolish income tax for these sectors. The average Indian is being pulverised. Allow his purchasing power to increase.

Clearly, India must decide whether it wants to reform the country within the window of 20 years. Ideology needs to be pushed aside in favour of sensible economics. Else the very future of the country could be at stake.

=========================

Do watch my latest podcast on Viksit Bharat (A developed India) at https://youtu.be/Q4jSp8l172s

COMMENTS