https://www.freepressjournal.in/analysis/policy-watch-india-could-witness-a-dramatic-decline-in-asian-leadership

Leadership also requires markets and money. India could lose out

RN Bhaskar

There are disturbing undercurrents in the Indian markets. On the surface the waters look calm. But underneath, they are restless. Investors, like swimmers, know that venturing into such waters requires immense caution. It is safer to avoid them.

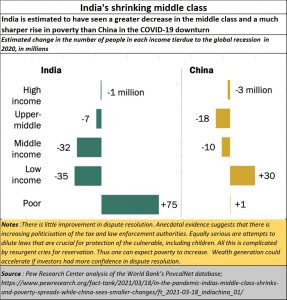

The chart alongside shows how Asian waters have suddenly got muddier than before. It tells you of the impact the pandemic had on two of the most populous countries in the world.

The chart alongside shows how Asian waters have suddenly got muddier than before. It tells you of the impact the pandemic had on two of the most populous countries in the world.

China trumps India

China emerges a champion. It managed both the pandemic and its economy better than India did.

True, the ultra-wealthy were bigger losers in China than in India. China saw a decline of 3 million among its ultra-rich; India just 1 million. But then, India had fewer ultra rich than China.

The upper middle class too suffered more in China than in India. China saw this number decline by 18 million. India by just 7 million. Ditto with the upper middle class.. China registered a decline of 18 million. India saw this category shrink by just 7 million.

But the numbers also suggest that even while Indian policies were apparently less harsh for its affluent and wealthier classes, they were almost brutal when it came to the general middle-class and the poor.

The Indian government had possibly introduced policies that protected the higher income and wealthier classes better than it could the middle income and poor segments. Evidently, the government does not practice what it preaches.

A similar situation could be found in the agricultural sector too. Hard data shows that contrary to what is being touted, the government is not really interested in farmer welfare. It is only interested in accumulating more power (https://www.moneylife.in/article/the-fight-is-no-longer-between-the-good-and-the-bad-but-between-the-corrupt-and-the-rapacious/62370.html).

When it came to the middle class, India saw this number shrink by 35 million, China by 30 million.

And when it came to poverty, China managed to ensure that not more than a million people slipped back into poverty. India saw this number go up by a whopping 75 million.

It is then that you realise that slogans like subka-saath-sabka-vikas (loosely translated as together we march towards prosperity) are only a chimera.

The way India’s politicians chose to hold election rallies amid a severe second wave of the pandemic was painful to watch. They exhorted crowds to gather, and assemble without masks or social distancing (http://www.asiaconverge.com/2021/04/elections-show-contempt-for-pandemic-rules/). Sadly, even the election commission stepped in only a fortnight later. And when it became clear that there were vaccine shortages, the centre brazenly put the blame on states (more on this can be found at https://youtu.be/BmZ2_fdmVuY).

However, in some ways, India was extremely harsh even towards its wealth generators. China, despite pulling people out of poverty and illiteracy, had encouraged wealth generation as well. No wonder then, when one looks at the total number of billionaires, China has trounced New York (see chart). Beijing is the new capital for billionaires.

However, in some ways, India was extremely harsh even towards its wealth generators. China, despite pulling people out of poverty and illiteracy, had encouraged wealth generation as well. No wonder then, when one looks at the total number of billionaires, China has trounced New York (see chart). Beijing is the new capital for billionaires.

In India, many of the billionaires were scamsters (compare the soft touch towards the Sandesarias (https://www.moneylife.in/article/fugitive-sandesaras-of-sterling-biotech-continue-to-do-business-with-indian-oil-psus/62901.html), with the treatment meted out to Vijay Mallya. The latter, unlike the former, was a wealth generator.

No wonder then, many of the good billionaires opted to take up citizenship outside of India. Indians remain the richest ethnic community in the US, and do very well anywhere in the world. But not in India. They are not comfortable with the capricious shifts in tax policies, and the selective targeting of anyone who is suspected of being friends with leaders of opposition parties. And there are others, who would like to be billionaires, but are cut to size by the crippling regulatory environment and all-pervasive corruption (http://www.asiaconverge.com/2021/03/the-judiciary-series/).

As a result, India has not been able to help its poor. It has not been favourable towards the wealthy either, especially those who make their money through legitimate means. But some politicians may love this situation. A not-so wealthy-class, and a teeming, desperately poor, population (without education and medicare) allows politicians greater ease in recruiting vigilantes and rent-a-mob rallies. Moreover, desperate people are more likely to suspend disbelief, and cling to the yarns politicians often spin.

Cashflows squeezed

Yet, when policies are mishandled, they have a way of turning back and biting their masters. And that is precisely what appears to be happening.

By January 2021, it became clear that the government’s ineptness had begun to create job losses. EPFO closed 71.01 lakh Provident Fund accounts in April-December 2020 (https://zeenews.india.com/india/job-losses-due-to-covid-19-epfo-closed-71-01-lakh-epf-accounts-in-april-december-2020-2348117.html). CMIE reported that of the 14.7 million jobs that were lost, 9.5 million were those of graduates and post-graduates.

Fewer jobs would mean poorer tax collections.

Fewer jobs would mean poorer tax collections.

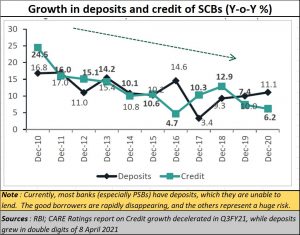

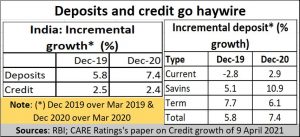

Had the policies for wealth generation been good, India would not see a sharp dip in both credit offtake and deposits (see chart).

When the climate is good for investments, credit offtake increases. But when the stench of mismanagement begins to rise, businessmen are swift in their response.

Good businessmen immediately swing into action to protect their existing investments, and choose not to make any additional investments, till the economic climate in India improves.

Hence they stayed away from committing themselves to major investment plans. Instead, they preferred to put their money in gold and the stock markets. That could also explain the decline in GFCF (gross fixed capital formation), a sure-fire indicator of inventor confidence in an economy.

Yes, there are those who are still willing to borrow. But they represent high levels of risk. Public sector banks (PSBs) therefore preferred depositing their money with the RBI. Hence, even while deposits increased, credit offtake declined. A look at the depositor profile is also interesting. Term deposits declined. Either the interest rates, or long-term expectations from the economy, had kept money away from long term deposits.

Money was there. But not for business or for long term investments. Not surprisingly, gold and market indices soared. Expect the markets to witness more turbulence when hard facts of the economy begin to sink in. Money will drift to safer territories instead.

Money was there. But not for business or for long term investments. Not surprisingly, gold and market indices soared. Expect the markets to witness more turbulence when hard facts of the economy begin to sink in. Money will drift to safer territories instead.

Currently, the absence of credible economic data worsens the situation. The government has chosen not to part with data on many of its activities. Even Lok Sabha replies are difficult to access, unlike earlier.

India marginalised

There is one bigger dark cloud that policy makers should now pay heed to. It is that of India being marginalised.

Saudi Arabia has ignored its call to reduce oil prices. India states that it will reduce its oil imports from that country. But this could be a self-fulfilling prophesy, as India’s oil consumption has already slipped by 9% — the first time since 1998-99 (https://www.businesstoday.in/sectors/energy/fuel-demand-contracts-91-in-fy21-first-since-1998-99/story/436234.html).

The US has begun conducting policing manoeuvres in the Indian Ocean without even consulting India (https://indianexpress.com/article/india/us-navy-freedom-of-navigation-operation-india-waters-without-consent-7265898/). India lodges a complaint. But will the US bother about it?

Border discussions between India and China continue to stretch. The last round of talks on 9 April over the disengagement in Eastern Ladakh at various friction points lasted for 13 hours (https://www.business-standard.com/article/current-affairs/disengagement-border-talks-between-indian-chinese-army-lasted-13-hours-121041000234_1.html). How many more Chinese businesses will India ban now?

To understand what it is happening, do listen to Shyam Saran’s talk that he recently gave on the Manthan platform (https://www.youtube.com/watch?v=CEI0tAJAtEk). Saran has been decorated with a Padma Bhushan, was former Foreign Secretary to the Government of India and was also (until 2015) Chairman of the National Security Advisory Board under the National Security Council. He explains how India’s leadership even in the Asian region is rapidly slipping.

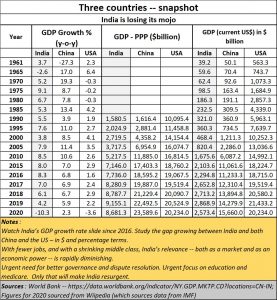

In 2003 when the then Prime Minister Atal Bihari Vajpayee visited China (https://www.livemint.com/Politics/X2JQZHZDEPGNBpMjLqCl9I/India-and-China-A-timeline-of-how-ties-have-unfolded-over-t.html) the world was aware of how India’s GDP growth rates had begun to march upward. By the time Chinese Premier Wen Jiabao and the then Prime minister, Man Mohan Singh, met in 2005 (https://www.fmprc.gov.cn/mfa_eng/topics_665678/wzlcfly_665842/t191395.shtml), everyone was talking about an Asian century lead by China and India. China exchanged maps with India for the first time (showing Sikkim as part of India).

Today, China talks about the emergence of an Asian century led by China. India is missing. And the reason is not hard to find. India has become a declining economic power. In a desire to win public support and elections, and in a grab for more and more political power, the Indian government has forgotten to nurture industry and wealth generation.

India is now known more for its bans and proscriptions. It has banned Chinese apps, Chinese finance companies and even technologies. It imprisons comedians, public speakers, and activists. And it unleashes the enforcement directorate on businessmen who sup with people critical of the government.

The consequence is that for China — and soon for the rest of the developed world — India may be rapidly losing relevance as an economic power. Even joining the Quad did not keep the US away from its territorial waters. .

That is not a comforting thought. But the harsh reality is that the world respects winners. And the most important measure for winning is business and commerce. India has shot itself in the foot. It refuses to ease dispute resolution. It has hurt farming in many ways (https://www.freepressjournal.in/analysis/a-shrinking-middle-class-could-roil-india-badly). It has hurt many businesses. And it has fiddled with regulatory structures in India, which will have grave consequences in the years to come (http://www.asiaconverge.com/2021/02/budget-2021-hurts-both-banking-and-atma-nirbhar-bharat/).

Opportunities missed

Just look at the chart alongside. India’s GDP growth rate has been falling year after year since 2016. Each time there was a different excuse. Had India’s middle-class segment been growing, India would have been a very tempting marketplace. As Deng Xiaoping said, “It doesn’t matter if a cat is black or white, as long as it catches mice”. India is fast losing its ability to seduce investors to its shore, or even capture market share.

Just look at the chart alongside. India’s GDP growth rate has been falling year after year since 2016. Each time there was a different excuse. Had India’s middle-class segment been growing, India would have been a very tempting marketplace. As Deng Xiaoping said, “It doesn’t matter if a cat is black or white, as long as it catches mice”. India is fast losing its ability to seduce investors to its shore, or even capture market share.

There were two industries in which India was #1 – dairy farming and gems & jewellery. The latter was allowed to slip into scams through government and banking connivance (http://www.asiaconverge.com/2020/11/diamonds-unsafe-for-investors/). The former is now being threatened with government measures aimed at reducing its clout (http://www.asiaconverge.com/2020/12/farmer-agitations-fueled-by-corruption-politics-and-power/). In the bargain, two other industries where India could be a global leader – leather and beef exports – could also suffer from collateral damage.

Can India create jobs quickly? Yes, it can. If only it heeds to sensible advice.

For years, the government was aware that the fastest route to job creation was through rooftop solar. Calculations show that around 80 million jobs can be created within a couple of years (http://www.asiaconverge.com/2017/12/sabotaging-rooftop-solar-and-employment-generation/). Germany discovered this in 2008. India had strategic advantages in this sector, because it had a lot more sun, and a lot many more people, hence houses, on a larger land mass. But, seduced by the siren songs of powerful industrialists, India pursued mega solar parks. The government even overlooked the runaway success rooftop solar had in Tripura (http://www.asiaconverge.com/2019/10/solar-energy%e2%80%88ministries-practice-deceive/).

It could have doubled the capacity of government owned hospitals to create more medical education seats for doctors and nurses. Instead, it has tried to fudge numbers by advocating short term courses to allow homeopaths and ayurveds to become allopaths. In doing so it is degrading educational standards and corrupting an already weakened system.

Goodbye to the potential of health tourism, and manpower exports. More doctors could have meant more rural clinics and nursing homes. That would have salvaged the Ayushman Bharat scheme (http://www.asiaconverge.com/2018/08/ayushman-bharat-great-concept-doctors-overlooked/). But the government hasn’t learnt or understood.

It could have made its domestic shipping fleet stronger. But once again, swayed by seductive calls from big industry, its gave away its coastal rights (cabotage) to foreign flag ships (http://www.asiaconverge.com/2018/10/indian-shipping-grows-overseas-not-in-india/).

It could have encouraged gold mining (http://www.asiaconverge.com/2021/01/gold-mining-series/). But instead of recognising the nature of gold deposits in India – suitable more for small mines developed by both prospectors and rural land-owners — the government has now passed a bill meant only for large industrialists. The one good policy change the government did introduce for gold was to reduce gold import duty from 15.5% to almost 10%.

It also did a lot of damage through selective gold targeting. It spent a lot of time and effort in tarnishing Kerala for the 25 kg gold smuggling, even while it stayed quiet about the 104 kg stolen from the CBI gold vaults (http://www.asiaconverge.com/2020/12/gold-mining-part-iii-a-colonial-outlook-has-stunted-indias-gold-mining-sector/). You don’t build national good will through such selective targeting. Without goodwill, a concerted effort for promoting economic growth becomes difficult.

That destruction of goodwill was visible more sharply in the national effort directed in demonising tablighis – the Muslims who came to participate in a religious conference in Delhi, but could not return in time because of the first Covid lockdown. Charges were made that they were spreading the Covid infection, that they had violated passport rules and more. One after another each case against the tablighis was dismissed by the courts (https://indianexpress.com/article/india/tablighi-case-all-foreigners-freed-court-slams-police-says-no-proof-7106554/).

You don’t help economic growth by polarising society – especially by filing false cases. Ditto with the sedition and anti-national-activities cases both UP and Bihar have been filing against people who did not pay heed to the government’s cow slaughter laws (https://indianexpress.com/article/express-exclusive/national-security-act-uttar-pradesh-police-detentions-cow-slaughter-ban-7260425/), or speak against the Citizen’s Amendment Act (https://indianexpress.com/article/india/sedition-charge-caa-nrc-lessons-anti-national-7266972/lite/). Once again, most of these cases have been thrown out by the courts.

Thus, one by one, the government has short sold its people, its strategic advantages, and has shrunk its middle class. It also shrank its wealth generators at the other end of the spectrum. And it has betrayed future generations by not focussing on quality education and medicare (http://www.asiaconverge.com/2020/08/the-national-education-policy-has-little-vision-less-strategy/).

Can the government roll back these myopic missteps? Can it recover? Yes, it can. It is obviously not a basket case. Not yet.

COMMENTS