https://www.freepressjournal.in/analysis/policy-watch-regulatory-games-2-how-sebi-muddies-the-waters

Regulatory games2

SEBI muddies the waters

It’s no go the merry-go-round, it’s no go the rickshaw,

All we want is a limousine and a ticket for the peepshow.

Bagpipe music (1938) by Louis MacNeice

RN Bhaskar

A look at recent developments at The Securities Exchange Board of India (SEBI) reminds one of the above lines. Maybe it should be titled ‘SEBI’s Song’.

This is because SEBI’s officers seem content to enjoy their perquisites, act imperious, refuse to reply to email queries, and pass judgements and issue notifications that make a mockery of corporate governance.

It makes one wonder if some of its officers are trying to enter into collusive relationships with market players. Explanations are urgently required to dispel such impressions. At present the instances cited below – out of countless other instances — underscore either ethical bankruptcy or non-application of mind. If there are other interpretations for the examples cited below, they must be aired quickly. The sooner, the better.

Corporate governance is a sacred word. But SEBI’s recent judgements appear to defile this phrase. The sacred has suddenly begun to invite ridicule.

Corporate governance is a sacred word. But SEBI’s recent judgements appear to defile this phrase. The sacred has suddenly begun to invite ridicule.

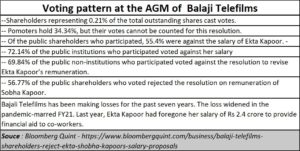

Consider some recent examples. On August 31, 2021, Balaji Telefilms Ltd.’s shareholders rejected proposals on the salary to be paid to Managing Director Shobha Kapoor and Joint Managing Director Ekta Kapoor (https://www.bloombergquint.com/business/balaji-telefilms-shareholders-reject-ekta-shobha-kapoors-salary-proposals). For two years starting Nov. 10, the maker of movies to television series had approved a basic salary of Rs 2.40 crore along with perquisites to Ekta and Shobha Kapoor, like previous years, according to disclosure to the stock exchanges.

When the results of the voting were declared on Sept. 2, the pattern that emerged was not dissimilar to what has been happening with most companies (see chart). Thus, with just 50% of the 0.21% of present voters, the salary resolution was thrown out.

In other words, SEBI has allowed the tail to wag the dog.

What happened at Balaji, is just an instance. Similar examples can be found across the corporate spectrum in India. SEBI has created rules that make managing any company extremely difficult.

Imperious SEBI

The trouble is that SEBI is usually impervious to questions and suggestions. That is a far cry from the times when this author used to interact regularly with the late GV Ramakrishna, the first chairman of SEBI. He explained his decisions. Accepted suggestions. And controlled the markets even though he had a fraction of the powers (and financial muscle) that SEBI currently enjoys. At present SEBI looks more like a place for merry-making.

The trouble is that SEBI is usually impervious to questions and suggestions. That is a far cry from the times when this author used to interact regularly with the late GV Ramakrishna, the first chairman of SEBI. He explained his decisions. Accepted suggestions. And controlled the markets even though he had a fraction of the powers (and financial muscle) that SEBI currently enjoys. At present SEBI looks more like a place for merry-making.

Take another instance. SEBI introduces a rule that independent directors can be appointed or removed only through a special resolution. A special resolution needs more than 75% of the votes. A normal resolution requires a simple majority. So, if 60% vote in favour of an independent director, he cannot get appointed, unless SEBI makes a special case. In other words, SEBI wants managements to come to it to beg it to use its discretionary powers. And as the adage goes, the greater the discretion, the larger the potential for corruption.

In fact, SEBI’s proposals are bizarre. This author sent an email asking SEBI if it had studied practices adopted in other countries. No reply was forthcoming. Was it because SEBI was disdainful? Or was it because it was ignorant? If it was the latter, here is a simple ready reckoner (see chart). Regulators are supposed to study all this. Clearly, either it was non-application of mind, or a reluctance to study, or mere caprice. None of these lends confidence to the role SEBI’s officials are playing!

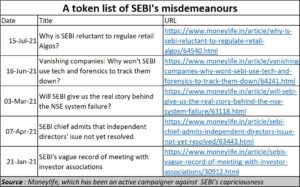

Bizarre conclusions

Not that SEBI has been unaware of the crassness of some of its decisions! Take a sampling of some of the recent articles penned against SEBI by Moneylife, which has been campaigning for investors’ rights and for corporate governance. Look at the issues raised. In one of the articles, SEBI even refused to note down what was discussed in meetings – a clear violation of rules governing meetings called by regulators. Has SEBI become a rule breaker? If it  chooses to break rules itself, how can it demand that others accept its rules?

chooses to break rules itself, how can it demand that others accept its rules?

- Take yet another example which shows the callousness and absurdity of SEBI’s rulings. Last week, SEBI ruled that two directors of Videocon Realty and Infrastructures Ltd and Electroparts (India) Pvt Ltd were guilty of insider trading and other malpractices It fined them Rs.1 lakh each (https://www.outlookindia.com/website/story/business-news-videocon-promoters-penalised-for-violating-trading-norms/394488). Preposterous!

The money that these two must have made from insider trading would have been at least 20 times larger, if not more. So, make Rs.20 lakh (a notional figure), get fined Rs.1 lakh, and go and enjoy the fruits of corruption, right?

When there is insider trading, or financial malpractice, one would expect a reasoned order to state the quantum of money that the person should have earned unlawfully. The penalty should be at least 10 times more plus interest from the day when the money was earned. So, if the ill-gotten gains were Rs.10 lakh, the minimum penalty should be Rs.1 crore. Plus, interest at say 12% (the rate the income tax department charges) for the time gap between the gains being made and the penalty paid.

With no computation of ill-gotten gains being made, and with a penalty of just Rs.1 lakh, you can be sure that the situation stinks.

- Take another instance of last week. SEBI fined Abhay Bhutalia and 7 other entities of Poonawalla Fincorp Rs.13 crore for insider trading (https://economictimes.indiatimes.com/markets/stocks/news/sebi-bars-poonawalla-fincorp-md-7-others-from-dealing-in-securities/articleshow/86238142.cms). That is aroundRs.1.6 crore per entity.

It needs to be mentioned here that Abhay Bhutalia has made clear his intention of challenging the SEBI claim and order. Expect fireworks.

In any case, at first glance, the SEBI order does appear to be out-of-sync with other orders.

- Another news item talks about SEBI banning 85 entities from the capital markets for one year for insider trading and other malpractices (https://www.moneycontrol.com/news/business/markets/sebi-bans-85-entities-from-capital-markets-for-fraudulent-trading-7436981.html). Is a one-year ban enough? What were the illicit gains each of these players made? Does that not have to be quantified first, and then made public. SEBI could use forensic experts who excel in this type of work. The public has a right to know.

A one-year ban only means that you send market players on a year-long vacation after they have made their ill-gotten gains.

- You also have SEBI slapping a fine of Rs.1.65 crore on Yes Bank and six others. Rs.13 crore for eight people? Rs.1.65 crore for seven? Rs.1 lakh each for two? Was SEBI going soft on Videocon? The regulator needs to do some explaining to the public.

Now compare the average fine of Rs.1.6 crore per individual in the case of Poonawala FinCorp with Rs. 1 lakh for the Videocon group directors and the one-year ban. Aberrations in Videocon’s annual reports were clearly visible, right from 2015, to anyone who cared to read them. SEBI army of scrutinisers ought to have seen the frauds coming. In fact, this author wrote about them, in 2018, even before SEBI began raising flags (https://asiaconverge.com/2018/05/chanda-kochar-must-go/).

In governance, there is a saying that unless the cost of non-compliance is significantly higher than the cost of compliance, non-compliance becomes immensely attractive. SEBI has succeeded in promoting non-compliance, notwithstanding claims to the contrary.

Quit India?

The result is that more and more Indians are desirous of listing overseas (see chart). This is partly because the ease of doing business is better overseas. Moreover, compliances are less  cumbersome. And added to all this is the greater ease in raising funds from potential investors.

cumbersome. And added to all this is the greater ease in raising funds from potential investors.

SEBI (plus RBI – see https://asiaconverge.com/2021/09/games-regulators-play-1-is-rbi-becoming-capricious/) has made India stifling. This is not what Make-in-India was supposed to be. As the government opens windows to allow common investors to invest overseas, expect more Indians to send money overseas, because SEBI has been known to pay the game of favourites in India.

Sensible investors abhor caprice and cumbersome processes. SEBI and other crass regulators could trigger another Quit India movement. Only this time, it will by Indian entrepreneurs who find the Indian regulatory setup stifling.

So, what should SEBI do?

- The first thing SEBI needs to do is to become more transparent.

- Disclose clearly, with supporting analysis by some of the world’s most reputed forensics firms – some of which are already working in India.

- Quantify the ill-gotten gains that fraudsters have made in each case. Sometimes, in addition to the gains, there are losses they have caused to the investing public through short-selling a stock. Quantify that as well. Without such a quantification, which can be publicly analysed and challenged, SEBI will remain a regulator working on cosy deals with rotten promoters.

- Once the figures have been quantified, follow a transparent norm. This norm should specify a fine of (say) ten times the ill-gotten gains, and (say) five times the damage to the investing climate. Always remember the golden rule regulators must follow – keep the cost of compliance significantly lower than the cost of non-compliance. The imperious men and women at SEBI have forgotten this rule.

- If the calculations are transparent, and the multiple (times) that should be used to impose a fine are known, and the need to charge interest for the delay is well advertised, there is little scope left for discretion. The greater the discretion, the larger the temptation to be corrupt. This way SEBI will prevent fat-cats from sitting over ill-gotten money for ten years, watch the money double (or treble) and then offer to pay a fine which is only a fraction of total earnings. That is a sure-fire path to corruption and collusion. This must stop. In other words, compute, reveal, add the multiple and then apply the interest. That will make SEBI more transparent.

- SEBI must primarily focus on identifying fraud. It should have done that with IL&FS, Videocon, the Sandesaria brothers . . . The list could go on. Desist from trying to meddle with corporate politics by creating bizarre election rules. SEBI’s primary responsibility is not to manage elections, but ensure that frauds do not take place. If the latter is ensured, elections and other such matters will take care of themselves. If you don’t detect fraud, and meddle with election rules, you create two buckets for graft and grease. Stop that as well.

- Carefully monitor unregulated bodies like investors associations, proxy advisory firms, portfolio managers and analysts. They have the potential to inflate and depress market prices and sometimes have hidden agendas. Get all market players to follow the same rules of disclosure and transparency. A selective approach here can make SEBI the biggest promoter of insider trading and market malpractices.

- Most important, make it worthwhile for Indian entrepreneurs to remain in India. Don’t drive them away. Quit India was all right when it was meant for the British. It was never meant for Indian, especially wealth generators.

SEBI is driving the wealth generators away. Please stop that immediately.

COMMENTS