Will debt spur India’s GDP growth this time despite textiles languishing?

RN Bhaskar

On 31 October, 2023, the RBI governor, Shaktikanta Das, stated that the growth momentum in the economy continues to be strong, and that the GDP number for the second quarter will surprise everyone on the upside (https://www.livemint.com/economy/indias-q2-gdp-number-will-surprise-everyone-rbi-governor-shaktikanta-das-11698757577182.html). If the statement was meant to regale the investor community, that announcement did not work. Instead, as Bloomberg reports, foreign portfolio investors (FPIs) have continued selling Indian shares in 26 of the 37 sessions through October 30, with Thursday’s selling of $768 million being the biggest single-day outflow since June 2022.

The numbers just don’t help justify this optimistic picture that the RBI governor tried to paint.

But do go beyond these numbers and consider how GDP growth rates have been falling and languishing for the past seven years (Free subscription: https://bhaskarr.substack.com/p/the-disintegration-ofgovernance?sd=pf). Then consider how unemployment rates are among the highest in this region (https://asiaconverge.com/2023/04/indias-confused-exim-strategy/).

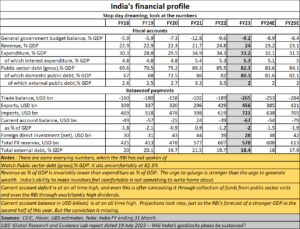

Then move over to the table which gives you the financial profile of the country. Separate the actuals from the projections. The latter are possibly aspirational. But the current set of numbers do not give anyone the comfort that the future will be very rosy. In fact, post elections 2024, it could be worse. The huge bank losses (or write-offs as the finance ministry puts it) have only helped the wealthy, not the common man (https://thewire.in/banking/a-decade-of-write-offs-how-the-govt-and-banks-failed-to-tacklenpas-and-helped-big-corporations). The common man has had to pay to the banks additional charges to help banks recover the money that corporates took away. This was through payment of SMS charges, increased locker charges, even charges for ATM cards and cheque books.

Consider how public sector debt (gross) as a percentage of GDP has stayed high. It stands at an uncomfortable 82%. True, this is nothing compared to the indebtedness of countries like the US and Japan. But such comparisons are odious. The latter two countries have an immense ability to generate wealth and still remain economic powerhouses for the entire world, even despite the high indebtedness.

Then observe how the growth in revenue has been slower than the growth in expenditure. It is obvious that the government has an irresistible urge to splurge (free subscription — https://open.substack.com/pub/bhaskarr/p/the-indian-governments-urge-to-splurge?r=ni0hb&utm_campaign=post&utm_medium=web).

Current account deficit is high, even after the government has tried to tamp it down by resorting to taking money from public sector units in the form of extra high dividends. It took money from the RBI as well (free subscription — https://bhaskarr.substack.com/p/the-shrinking-growth-of-the-middle?r=ni0hb&utm_campaign=post&utm_medium=web). What this means is that when the elections are over, and the urge for more freebies will get muted a bit, many organisations will not have the elbow room to expand, and may have to swim through red ink. Not a very pleasant state for the economy to be in.

And do bear in mind that the current account deficit (exports minus imports) has been soaring and import cover has been declining (free subscription — https://bhaskarr.substack.com/p/the-indian-governments-urge-to-splurge?r=ni0hb&utm_campaign=post&utm_medium=web). The Indian rupee (INR) continues to weaken (https://www.bqprime.com/business/indian-rupee-weakens-against-the-us-dollar-19), as it was expected to. This will make export earnings struggle a lot more than before to stay at the same level.

And when it comes to projections, it is easy to conjure up rosy scenarios – both for drunks and the sober.

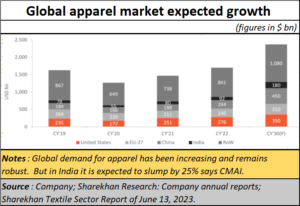

The first wake-up call – like a splash of cold water on a frosty morning – came last week when the Clothing Manufacturing Association of India (CMAI) stated that the industry expected demand to shrink by up to 25% this festive season compared to last year (https://www.livemint.com/news/india/most-apparel-makers-expect-up-to-25-less-demandthis-festive-season-cmai-11698652339116.html).

This alone should have caused alarm bells ringing inside the RBI. This sector is both an exporter and a major employer — even though it accounts for a 2% share in the country’s GDP, and a 7% share in industry output. If this sector is in trouble, expect employment to be hit as well. That will result is a downward spiral. As one looks across the industrial landscape, nothing explains the crisis as well as the textiles sector.

What is galling is that India’s consumption should decline when, globally, demand for apparels is on the upswing. Clearly, something has made the purchasing power of Indians shrivel. This is yet another proof that the middle class is under tremendous strain (free subscription — https://open.substack.com/pub/bhaskarr/p/the-shrinking-growth-of-the-middle?r=ni0hb&utm_campaign=post&utm_medium=web).

Visionary claims get made . . .

Visionary claims get made . . .

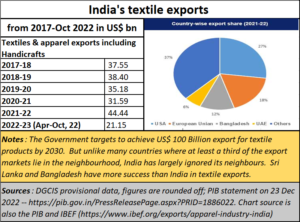

Notwithstanding these achievements, the government of India likes to make visionary statements. It claims that India’s exports of around $40 billion should cross $100 billion by 2030.

But if actual exports are considered, India has been slipping badly.

States Avendus Spark in its report, dated 28 February 2023, on the textiles sector, despite a steady market share, knitted RMG [ready-made garments] exports declined by~13% on the back of weak underlying demand. Even apparel volumes fell by around 24%. The US share of Indian imports dropped by around 22 bps y-o-y during the quarter. And EU imports of Indian knitted RMG also declined considerably during the quarter.

… even as source cotton remains ignored

… even as source cotton remains ignored

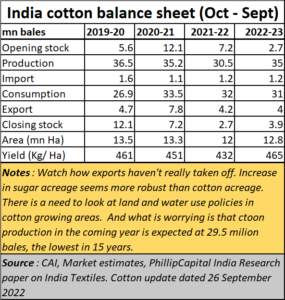

Thus, while all eyes are glued to the final produce, scant attention has been paid to the fundamental input – cotton – which helped the Indian textile industry grow.

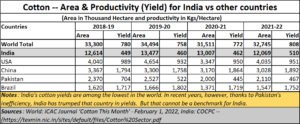

Normally, India’s planners should have paid equal attention to cotton. After all, India is a major cotton producing country. According to the government of India (https://texmin.nic.in/sites/default/files/Cotton%20Sector.pdf), “cotton is one of the most important commercial crops cultivated in India and accounts for around 25% of the total global cotton production.”

The government document goes on to add that cotton plays a major role in sustaining the livelihood of an estimated 6 million cotton farmers and 40-50 million people engaged in related activity such as cotton processing and trade. Due to its economic importance in India, it is also termed as “White-Gold”.

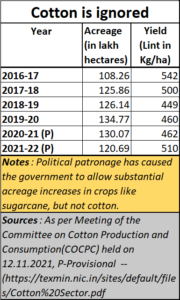

But when one looks at the entire cotton sector, there is clear evidence of government apathy. Consider how cotton acreage has not gone up even though sugarcane acreage, which grows in proximate areas, has been allowed to add acreage year after year (https://asiaconverge.com/2023/03/maharashtra-has-a-fatal-obsession-for-sugarcane/). Clearly, sugarcane has more political patronage than coton, which remain a key employer, and a major contributor to India’s exports. Nor have yields gone up.

But when one looks at the entire cotton sector, there is clear evidence of government apathy. Consider how cotton acreage has not gone up even though sugarcane acreage, which grows in proximate areas, has been allowed to add acreage year after year (https://asiaconverge.com/2023/03/maharashtra-has-a-fatal-obsession-for-sugarcane/). Clearly, sugarcane has more political patronage than coton, which remain a key employer, and a major contributor to India’s exports. Nor have yields gone up.

In fact, for any planning in textiles, it is imperative that one begins with cotton. But as data from the government itself shows, India’s cotton is languishing. It is actually wilting.

In fact, for any planning in textiles, it is imperative that one begins with cotton. But as data from the government itself shows, India’s cotton is languishing. It is actually wilting.

India has invested very little in creating varieties which would help the farmer improve cotton yields.

Together with the country’s land use policies, cotton has been ignored. Yet the government continues to wax eloquent about how much it does for farmers and for employment. The best way to show that the government is not honest about such claims are to point to the textiles and cotton sectors.

Instead, the government keeps painting even more rosy scenarios. Chaina is losing its share in textile exports is a constant refrain. Maybe yes, but China is opening joint ventures with locals in other countries like Vietnam, Indonesia, Sri Lanka the Philippines, and Mexico. That share is not coming to India. India must begin looking to becoming more competitive by focussing on cotton first – it is a major employer too – and on helping the industry bring out better products. India is an attractive place to do business in. Consider how Sri Lanka’s Brandix has opened a huge plant in Visakhapatnam to make high value garments for exports and possibly also for India’s domestic market (https://asiaconverge.com/2023/10/brandix-has-big-plans-for-its-india-venture/). If Brandix can do business in India, surely other Indians can do so as well.

It requires the government to turn its eyes away from capital intensive manufacturing and its PLI (Performance Linked Incentive) schemes (https://asiaconverge.com/2022/10/pli-and-the-indian-economy/) and begin looking to sectors where India has already shown the world that it has heft and potential.

So, is RBI wrong?

RBI believes India’s GDP will soar in the second half of this financial year. Using conventional tools, this does not seem likely.

There could be another explanation. RBI and the government could be trying to boost India’s GDP through even more borrowings. It is possible to grow GDP through debt. Someone may borrow thousands of crores to build a bullet train (https://asiaconverge.com/2023/10/govt-urge-to-splurge/). But if it does not become economically viable, and if other sectors are not nurtured simultaneously, it is possible for GDP to grow briefly. But such debt induced GDP growth could have disastrous consequences.

That is something that RBI and India’s economy planners need to think about very seriously.

COMMENTS