https://www.freepressjournal.in/business/policy-watch-the-lure-of-online-groceries-is-growing-stronger-and-stronger

Online groceries to witness booming times ahead

RN Bhaskar – 16 April 2020

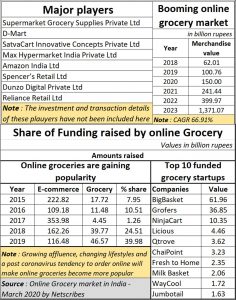

The business of online groceries has been growing at 67% year on year.

There are several factors that have propelled this growth. First, India as a consumption economy. Second, a growing, upwardly mobile middle class that wants the luxury of ordering from home. Third, and this should be a surprise, the coronavirus scare itself.

Obviously, a consumption class, besides purchasing consumer goods, and vehicles, also climbs the ladder of food consumption and other household needs. This includes the convenience of ordering using a mobile app or the PC.

Obviously, a consumption class, besides purchasing consumer goods, and vehicles, also climbs the ladder of food consumption and other household needs. This includes the convenience of ordering using a mobile app or the PC.

The shopping complex, or the neighbourhood store is always there to pick up one or two items. However, the range of goods and the ability to tempt consumers to go in for impulse buying, and at times attractive prices and offers as well, are what drive business to online stores.

The current coronavirus related lockdown could cause a dampener, true. But this may be temporary. With restaurants and malls becoming possible areas from where infection could spread, expect more people to order and dine at home.

Yes, the lockdown has hurt this industry. It is not unusual to find almost everyone reach for the phone to see if any of the online groceries is in a position to deliver daily household items – detergents, cleaners, fruit, vegetables, and even food. Most online stores aren’t in a position to deliver.

Initially, these online stores were compelled to stop deliveries because the national lockdown also included a ban on delivery boys. When that ban was lifted, albeit selectively, half the delivery boys had already migrated to their homes in rural areas (a health hazard). They are still struggling to operate at full capacity.

But look around, The small online grocery stores that serve very small geographical areas, or small communities, are still around. They have focused on their limited distribution and supply networks. Although their range of offerings has diminished, their services are still around. Clearly, the more social distancing is in vogue, the desire to order online, than march into a crowded store, will continue to propel the growth of online groceries.

It is this tenacity of the promoters of online grocery services, and a booming market growing at 67% CAGR (see table), that has made financial pundits look more closely at this sector. That could explain why more money has been flowing into online groceries than in other internet related offerings. What is interesting is that — even if we leave aside big players like Amazon, Reliance, Walmart, D-Mart and Spencers, who have very large deep pockets – the share of venture money flowing into online groceries has been increasing, in values and percentages.

What is also interesting is the way everyone, even the government, now realises the dangers of having a nationwide lockdown. It has affected millions of boys who zipped across cities delivering groceries as well. It is as if the country has, possibly for the first time, realised how crucially important the small man is. The delivery boy who brings eggs and bread to your house. The person who drives his tempo to your doorstep to deliver to you the groceries that you had ordered.

You will now see the online grocery concept gaining popularity in tier 2 and tier 3 cities as well. This is because this business is quite profitable, though it requires lots of money to set up the backend facilities. Yet, notwithstanding big players like BigBasket (which accounts for almost one-third of the online groceries market), Grofers and Amazon, and even though most of the new players compete for a share of the remaining 5% of the market, the size of this Rs, 10,000 crore business keeps growing at a frenetic pace.

The customer is fickle, true, Hence, many companies have introduced subscription schemes, loyalty discounts and no-delivery-charges for bulk purchasers. Bulk is beautiful. Competition is high, but there is space for the tenacious.

Whether the slump in the markets post lockdown will hurt this industry irreparably remains to be seen. It all depends on how quickly delivery boys are brought back to their feet, and how quickly lockdown conditions are eased. And expect this industry to consolidate itself by getting into contract farming with farmers and other suppliers. If the government is sensible, it will allow linkages between online groceries, insurance companies, and farmer and producer communities to grow so that all parties, including the customers benefit.

Yes, the growth rates will falter, but they are unlikely to go away. India’s consumption story – and that of online grocery stores — is still intact.

COMMENTS