India’ economy is not as robust as the RBI report claims

RN Bhaskar

India’s central bank, the Reserve Bank of India (RBI) just brought into the public domain its annual report for 2022-23 (https://www.rbi.org.in/Scripts/AnnualReportPublications.aspx?year=2023). As always, economy watchers wait for this report, and study its contents very carefully.

This author did likewise. The text suggests that all is (almost) well with the Indian economy, and that it is poised to touch greater heights. But a close reading of the tables leads to furrows on the brow. There are contradictions and implications that the RBI report does not even dwell on. To be fair, the RBI has provided the tables, which in turn lead to the queries.

This author did likewise. The text suggests that all is (almost) well with the Indian economy, and that it is poised to touch greater heights. But a close reading of the tables leads to furrows on the brow. There are contradictions and implications that the RBI report does not even dwell on. To be fair, the RBI has provided the tables, which in turn lead to the queries.

The adulation

First, take the RBI’s own statements:

- “In this turbulent global economic environment, India has experienced macroeconomic and financial stability with a steady pick-up in the momentum of growth.”

- “As inflation eases from its high reaches under the combined impact of monetary policy actions and supply management, fiscal consolidation reduces debt and deficit levels from pandemic-induced highs, the current account deficit remains within sustainable levels; macroeconomic stability is getting entrenched. Strong and healthy balance sheets of banks, financial institutions and corporate entities is helping to regain growth momentum eroded by the pandemic and the war.”

- “Medium-term prospects have been brightened by the demographic dividend, the digital revolution, policy initiatives to transform India into a global manufacturing hub, a resurgence in services sector competitiveness and favourable geo-economic positioning that is underway.”

- “In the industrial sector, manufacturing activity withstood global spillovers, while electricity generation exhibited robust growth, and mining recorded steady activity.”

- “Major labour market indicators – all-India unemployment rate, worker population ratio (WPR) and labour force participation rate (LFPR) surpassed their respective pre-COVID levels in Q1:2022-23.”

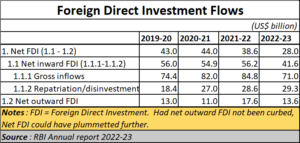

- While net capital inflows dominated by foreign direct investment (FDI) and banking capital supported financing of CAD, significant foreign portfolio outflows during the year necessitated the drawdown of foreign exchange reserves.

Worrying signs

Then study the tables.

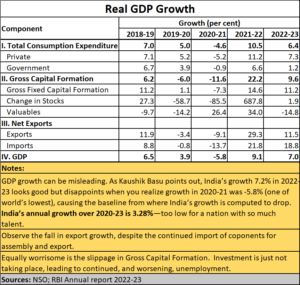

First. India’s GDP growth is not as rosy as is being made out to be. Listen to Kaushik Basu (http://kaushikbasu.org/), Professor of Economics and Carl Marks Professor of International Studies at the Department of Economics and SC Johnson Graduate School of Management, Cornell University, Ithaca and New York (he was earlier the Chief Economic Adviser to the Indian government. In a Tweet (https://twitter.com/kaushikcbasu/status/1664116186114605057) he says, “India’s growth 7.2% in 2022-23 [the RBI report shows only 7%] looks good but disappoints when you realize growth in 2020-21 was -5.8% (one of world’s lowest), causing the baseline from where India’s growth is computed to drop. India’s annual growth over 2020-23 is 3.28%—too low for a nation with so much talent.”

The RBI report is silent about this.

Also watch two other indicators in this table.

Also watch two other indicators in this table.

India’s export growth has declined in 2022-23 when compared to the earlier year. This is despite the surge in exports based on imported components which were then assembled and re-exported. That is what Raghuram Rajan, former governor of the RBI (and currently Professor of Finance at the University of Chicago’s Booth School) has in mind when he says (https://www.livemint.com/opinion/online-views/mint-explainer-raghuram-rajan-is-right-about-india-s-mobile-phone-exports-11685542196321.html) that the exports are being driven by assembly and not manufacturing. The data he provides confirms these views. The RBI is silent on this as well.

Similarly, the RBI does not talk about the controversial PLI which helped this surge in assembly operations, and which industrialists like Rajiv Bajaj have been critical about (https://www.business-standard.com/companies/interviews/ev-subsidies-flawed-and-unfeasible-says-bajaj-auto-md-rajiv-bajaj-123051801336_1.html). It is such policies that have resulted in a hollowing out of India (https://asiaconverge.com/2023/05/indias-economy-is-being-hollowed-out/).

That also explains why India’s current account deficit (CAD) is worsening, and why exports are shrinking. Somewhere, India seems to have forgotten where its export strengths lie. For instance, it has forgotten that leather – which is labour intensive – is a major export item. But ideology-driven policies have made India’s policy makers forget this important sector (https://asiaconverge.com/2023/04/indias-confused-exim-strategy/).

Myopic policies on the one hand, and the excessive use of the police and enforcement apparatus to clamp down on businesses, have driven high networth individuals away from this country, and a swell in the number of Indians surrendering their passports (https://asiaconverge.com/2022/07/major-financial-turbulence-ahead-inr-may-weaken-further/). Both are bad omens for a country which wants to be counted among the world’s best economies.

Myopic policies on the one hand, and the excessive use of the police and enforcement apparatus to clamp down on businesses, have driven high networth individuals away from this country, and a swell in the number of Indians surrendering their passports (https://asiaconverge.com/2022/07/major-financial-turbulence-ahead-inr-may-weaken-further/). Both are bad omens for a country which wants to be counted among the world’s best economies.

That in turn has led to a decline in Gross Capital Formation. Investment is just not taking place. The rapid decline in Net Fixed Assets (NFA) is not even looked at by the RBI report. “NFA growth has declined steadily from about 25 per cent real in 2007-08 to about 0 per cent real in 2021-22”, says Ajay Shah, Senior Research Fellow and Co-founder, XKDR Forum (https://www.business-standard.com/opinion/columns/better-numbers-in-private-projects-123052800863_1.html). When coupled with the decline in foreign direct investment (FDI), the country is confronted with three problems.

- First, policies that contribute to a decline in rural purchasing power.

- Second, a decline in gross capital formation, and declining FDI, and

- Third, a surge in unemployment.

Unemployment

The unemployment scenario is extremely worrying. That is another concern that the RBI overlooks. And this is what Mahesh Vyas and Natasha Somayya of CMIE explain (https://www.business-standard.com/opinion/columns/unemployment-rate-rises-in-april-123050100899_1.html) in their column. “India’s unemployment rate increased in April to 8.11 per cent from 7.8 per cent in March 2023. The unemployment rate has been on an upward trend since the start of the year, recording an increase for the fourth consecutive month.” They point out how the “labour participation rate (LPR) inched up from 39.77 per cent in March to 41.98 per cent in April 2023. This is the highest LPR recorded in the past three years.” Such fears are echoed by Reuters as well (https://www.reuters.com/world/india/despite-world-beating-growth-indias-lack-jobs-threatens-its-young-2023-05-30/).

One of the biggest factors leading to unemployment is the government’s agricultural policies (https://asiaconverge.com/2023/01/sodhis-resignation-has-dire-warnings-for-agriculture-and-milk/). The way the government has treated the cattle industry and cattle traders is both short-sighted and ugly. That has crimped leather and beef exports. In turn that has hurt employment. Another problem is the government’s penchant for banning commodity trades (https://asiaconverge.com/2022/12/the-government-prevents-farmers-from-being-self-reliant/). Together they have reduced agricultural purchasing power on the one hand, and have contributed to an industrial slowdown on the other.

Poor investment, worsening employment, and flagging exports are in turn changing the very structure of the Indian economy for the worse.

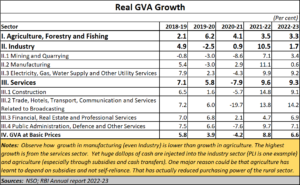

Look at sector-wise contribution to the national Gros Value Added (GVA). It shows that industry — which was supposed to grow faster than agriculture — has become the worst performing sector. Agriculture has grown faster than industry, though it is possible that this is on account of the subsidies and cash transfers that the government has pampered farmers with. True, the free food and cash transfers may have made the poverty more bearable (https://www.project-syndicate.org/commentary/welfare-policy-explains-why-india-prime-minister-modi-still-popular-by-arvind-subramanian-and-josh-felman-2023-04), but it has taught the rural community to survive on doles and subsidies instead of becoming self-reliant. That can be extremely counter-productive. TN Ninan, chairman Business Standard points to (https://www.business-standard.com/opinion/columns/shadows-on-sweet-spot-manufacturing-grew-the-least-among-sectors-in-fy23-123060200854_1.html) this absurdity where manufacturing has grown poorly. “At 1.3 per cent for 2022-23, it is slower than for all other segments of the economy, including agriculture (4 per cent). Even more strangely, this is not unusual. If you take the last four years together, agriculture has grown by over 19 per cent, while manufacturing has grown by only 13 per cent. It is a funny “developing” economy in which manufacturing is the slowest sector, slower even than agriculture.”

Look at sector-wise contribution to the national Gros Value Added (GVA). It shows that industry — which was supposed to grow faster than agriculture — has become the worst performing sector. Agriculture has grown faster than industry, though it is possible that this is on account of the subsidies and cash transfers that the government has pampered farmers with. True, the free food and cash transfers may have made the poverty more bearable (https://www.project-syndicate.org/commentary/welfare-policy-explains-why-india-prime-minister-modi-still-popular-by-arvind-subramanian-and-josh-felman-2023-04), but it has taught the rural community to survive on doles and subsidies instead of becoming self-reliant. That can be extremely counter-productive. TN Ninan, chairman Business Standard points to (https://www.business-standard.com/opinion/columns/shadows-on-sweet-spot-manufacturing-grew-the-least-among-sectors-in-fy23-123060200854_1.html) this absurdity where manufacturing has grown poorly. “At 1.3 per cent for 2022-23, it is slower than for all other segments of the economy, including agriculture (4 per cent). Even more strangely, this is not unusual. If you take the last four years together, agriculture has grown by over 19 per cent, while manufacturing has grown by only 13 per cent. It is a funny “developing” economy in which manufacturing is the slowest sector, slower even than agriculture.”

Another peculiar development is the government’s decision to rely on the Ways and Means (WMA) mechanism (formulated by the RBI) rather than the conventional CMB (cash management bills) for financing its deficits – through which it funds its subsidies and largesse (https://www.informistmedia.com/chome/govt-source-says-mulled-cmbs-apr-opted-wma-cost-lower/). CMBs are short-term debt instruments issued for periods under 91 days and used to smoothen temporary cash mismatches. They function much like T-bills, discounted at issuance and tradable in the secondary market. But the government opted for the WMA route.

“This has resulted in the government using Rs.486.77 bln rupees from WMA to fund the fiscal deficit of Rs.17.331 trillion 2022-23 says data from the Controller General of Accounts” points out Informist Media (https://www.informistmedia.com/govt-dipped-into-wma-to-fund-fiscal-deficit-for-fy23-data-shows/). The RBI report is silent on the use of this mechanism as well, which in turn does not reflect the right fiscal deficit situation. It adds, “The government also used up its entire cash balance in 2022-23 to fund the fiscal deficit. . . . . The government, which ended 2021-22 with a cash balance of Rs.353.52 billion, used all of it to fund the fiscal deficit for the year ended March.”

Clearly, the government requires to rethink its economic policy. Documents like the RBI report need to become more transparent, so that better informed people can then advise India’s policy makers on the best route for course correction. The crisis confronting India is likely to get worse and hence the need for a major re-think.

First, you cannot have a vibrant India without good education. Most indicators point to a worsening economic climate if the most important asset the country has – its demographic dividend – is not primed to perform better. The recent amendments to the NCERT books, which affect the very foundation of a child’s education in school is a worrying sign (https://www.freepressjournal.in/education/ncert-outlines-6-reasons-why-chapters-from-textbooks-for-class-10-were-eliminated). It is unwise to use the excuse of “stress for students” to dumb down the syllabus, or to remove chapters that are driven by ideology and not common sense. The current state of education in India is pathetic (https://bhaskarr.substack.com/p/the-state-of-education-in-india – free substack subscription). Unless that is improved – through proper outcome measurements — India’s future looks bleak.

Second, please stop this hype about GDP and tax buoyancy which can be quite illusory (Free subscription — https://bhaskarr.substack.com/p/indias-gst-and-gdp-gas-balloons?sd=pf) Focus on making agriculture more profitable by reviving the cattle trade and commodity trading (https://asiaconverge.com/2020/04/for-milk-subsidies-is-the-path-to-perdition/). Subsidies and cash transfers can lead to electoral populism, but they can easily make a Venezuela out of India. Resume trading in commodity futures

Third, find more sensible ways to raise funds. The tax of 20% on remittances overseas is pernicious and self-defeating. You cannot have a government talking about a confident India, yet introduce measure which show the financial underpinning filled with jitters and fears.

Fourth, get your expenses under control. The surge in Aadhaar cards, the ballooning of subsidies and entitlements (free subscription https://bhaskarr.substack.com/p/indias-election-peril-aadhaar-and?sd=pf) threaten to render infructuous all attempts to control either expenses or even elections. That in turn has compelled people like EAS Sarma to ask the Home Ministry and the CAG to step in (free subscription — https://bhaskarr.substack.com/p/eas-sarma-asks-home-ministry-not?sd=pf),

Finally, spell out the rules for rupee trade. Already you have Russia complaining that it has not been told how to spend the bills of dollars India owes it through the rupee trade (https://www.businessinsider.in/policy/economy/news/russia-doesnt-know-what-to-do-with-the-1-billion-in-rupees-it-is-amassing-in-india-each-month/articleshow/100676904.cms). Russia does rupee trade deals with India to export its oil. That involves an equivalent of USD 1 billion each month. India’s balance of trade and foreign exchange reserves could be different if these amounts are also included. There are other related issues as well. Can Indians carry Indian currency with them when travelling to rupee designated areas? Can an Indian purchase gold in Dubai using his rupee accounts? Or will he have to pay both the remittance tax of 20% and the import duty on gold of 15%. Policies relating to gold threaten to further weaken the Indian currency (https://asiaconverge.com/2022/11/when-the-cad-swells-it-is-easy-to-blame-gold/).

India needs to think through these policies quickly else it will be confronted with a demographic crisis on the one hand and a financial mess on the other. Unfortunately, none of this is what the RBI report talks about.

COMMENTS