INVESTMENT PERSPECTIVE

By J Mulraj

Jan 15-22, 2023

Yak-yak is better than ack-ack!

The illustration above (created using a software called DALL -E) indicates the perils of ignoring inter-dependency; if they let go, both would fall in the abyss.

The world is so inter-twined...

INVESTMENT PERSPECTIVE

By J Mulraj

Jan 8-14, 2023

Yes, if the myopic polity gets off its high horse!

The latest of several exciting technological innovations is ChatGPT. A chatbot, launched by OpenAI in November 2022, it performs as a code editor, an idea...

INVESTMENT PERSPECTIVE

By J Mulraj

Jan 1-7, 2023

Conflicts, Distrust, De-globalisation, Inflation, far too many canaries

The Ukrainian Canaries: What a tragedy of errors the collective West has made, by not giving heed to Russian concerns over NATO expansion, but, instead, engaging in...

INVESTMENT PERSPECTIVE

By J Mulraj

Dec 25, 2022 - Jan 1, 2023

The role of financial and technological innovations in their rise and demise

In November 2022 crypto exchange FTX, once valued at $ 32 b., collapsed, along with its sister concern, Alameda...

INVESTMENT PERSPECTIVE

By J Mulraj

Dec 18-24, 2022

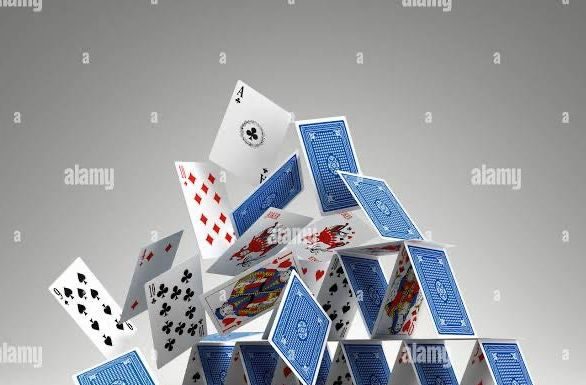

A Credit Event Will Trigger A Crisis

The ancient Egyptians were wiser than today’s Central Bankers. They built pyramids with broader bases and narrower tops. This is, of course, a stable structure. Today’s Central Bankers...

INVESTMENT PERSPECTIVE

By J Mulraj

Dec 11-17, 2022

Too many factors make it difficult

There are too many factors working towards pushing the world into a recession. Some countries may already be in one. The creation of excess money supply to help during...

INVESTMENT PERSPECTIVE

By J Mulraj

Dec 4-10, 2022

Curiouser and Curiouser, unbelievably stupid decisions by world leaders

Just as Alice exclaimed, some decisions made by the collective west are getting curiouser and curiouser. At the October/November 2021 Glasgow COP world leaders made pledges...

INVESTMENT PERSPECTIVE

By J Mulraj

Nov 27- Dec 3, 2022

De-globalisation and de-dollarisation are worrying trends

A dip into history is necessary to understand the context.

America had, post the two world wars, taken over the mantle of global leadership from a war ravaged...

INVESTMENT PERSPECTIVE

By J Mulraj

Nov 20 - 26, 2022

Economic losses from wars, corporate frauds, and bad lending

Countries create the systems, and the infrastructure for citizens to earn a living, cumulatively termed GDP, or gross domestic product. Alas, this cauldron, containing...

INVESTMENT PERSPECTIVE

By J Mulraj

Nov 13-19, 2022

The coming recession

The announcement, last week, of lower CPI inflation in USA cheered the market, on hopes that the Federal Reserve would lift its foot off the pedal, and raise interest by less than...