India’s numbers only tell a fragmented story

RN Bhaskar

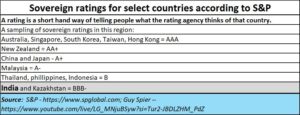

In January 2024. Fitch affirmed a BBB- rating for India (https://economictimes.indiatimes.com/news/economy/policy/fitch-maintains-bbb-sovereign-rating-for-india-with-a-stable-outlook-amid-strong-growth/articleshow/106904607.cms?from=mdr). So did almost every other major ratings agency in the world. Many in the government, and a few outside it as well, hollered, and said that the rating was unfair; that India deserved better. They cite numbers to justify their indignation and dismay. It is only when you go beyond India’s numbers (the Bing generated image above suggests that) that you begin to see what has gone horribly wrong, despite the chest thumping and accusations of unfairness.

A BBB- rating is not the best position to be in. It is the last grade below which the country slips into speculative territory, denoting a risky investment environment.

India falls into this category, along with Kazakhstan according to S&P data. A sampling of the ratings other countries got shows how far India has yet to climb. This is notwithstanding the clarion announcements about the country becoming a $ 5 trillion economy, or a $15 trillion or a $35 trillion economy or even more – depending on the year by when this status could be achieved.

The danger of slipping below investment grade into the speculative grade territory is always a frightful possibility.

The danger of slipping below investment grade into the speculative grade territory is always a frightful possibility.

Beyond the numbers

If one looks beyond the GDP number, there are several alarming factors.

Look at the decline in gross capital formation (https://asiaconverge.com/2024/01/what-after-ram-mandir/) and FDI (foreign direct investment). Or the growing trade balance (https://asiaconverge.com/2023/12/india-in-2024/). Or concentrate on the declining rate of consumption in the Indian market, which in turn is bruising FMCG companies (https://www.livemint.com/market/mark-to-market/no-respite-soon-for-fmcg-companies-11708844660707.html).

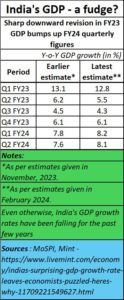

Even when it comes to the GDP, there are senior economists who candidly admit that the current claimed surge in GDP is inexplicable. That the numbers just don’t add up, says economist Arvind Subramanian (https://www.youtube.com/watch?v=rNvsoarXIAk at 04:08). As Voltaire would have put it, the emergence of large companies is fine, but . . . The service sector’s export performance is impressive, but . . . The inward remittance numbers look great but . . .

Even when it comes to the GDP, there are senior economists who candidly admit that the current claimed surge in GDP is inexplicable. That the numbers just don’t add up, says economist Arvind Subramanian (https://www.youtube.com/watch?v=rNvsoarXIAk at 04:08). As Voltaire would have put it, the emergence of large companies is fine, but . . . The service sector’s export performance is impressive, but . . . The inward remittance numbers look great but . . .

It is the buts that are rapidly turning from concern into alarm. Some of the economists point out that the high GDP growth rate was possible by lowering the growth rates of the previous year, so that in percentage terms, India’s GDP could look good.

And finally, there is the spectre of unemployment. Just pay heed to the warnings of Kaushik Basu, former chief economic adviser Government of India and currently Professor of Economics and Carl Marks Professor of International Studies at the Department of Economics and SC Johnson Graduate School of Management, Cornell (https://kaushikbasu.org/). In a tweet on 25 February 2024, he said that India’s unemployment situation was “worrying”. He adds, “This is not the column in which India should be. Such high youth unemployment is damaging India’s human capital & hurting the common person. We must look at data & take policy action & not live by slogans.”

In fact, with high unemployment coupled with poor education, you have an army of youth willing to go on a rampage. And there are enough stories about how easy it is to hire such people for riots, or crowds at election rallies, for targeting people whom the politicians want you to hate, and even playing the role of hired gunmen ready to kill for a fee. To assuage such large numbers, the doles and freebies of the government could be looked at as a method to quell the fires that threaten to rage and scorch India. The proposal to have more reservations, for castes and sons of the soil, and even citizenship based on religion, must be viewed in the light of these numbers (free subscription — https://bhaskarr.substack.com/p/what-after-the-ram-mandir?sd=pf) .

These are the factors that should worry any investor. They could even justify the poor sovereign ratings India currently enjoys.

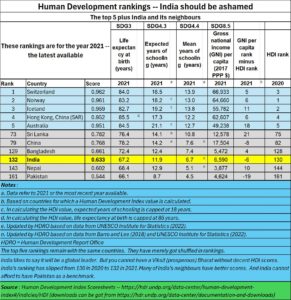

Nothing has hurt India as grievously as the sheer neglect by successive governments of its biggest resource – its people.

This is not what India’s neighbours have done. Watch the schooling and life expectancy of countries like Sri Lanka and Bangladesh. This country is slipping into the same ranking as Pakistan and Nepal. And yet you have people claiming that India should tell its success story better (https://www.youtube.com/live/LG_MNjuBSyw?si=Tur2-JBDLZHM_PdZ). Clearly, they appear to be keen on winning favours with the government and other agencies.

Schooling has collapsed (free subscription — https://bhaskarr.substack.com/p/the-state-of-education-in-india). Medicare is patchy and collapsing, notwithstanding tall claims about the government’s flagship healthcare programme, Ayushman Bharat (https://asiaconverge.com/2018/08/ayushman-bharat-great-concept-doctors-overlooked/).

The number of doctors remains woefully inadequate. Yet, each year, India continues to create hurdles in granting recognition to tens of thousands of students who have studied medicine overseas. This appears to be the result of continued pressure from a domestic lobby, which is incompetent, unwilling, and incapable of ramping up the number and quality of medical seats in India. That, in turn, has increased the cost of medicare, hence of health insurance. Sadly, just recently, even the Supreme Court had to step in and ask the government to fix hospital charges for the entire country. But this has raised other questions – why not fix the rates for auditors, and lawyers as well? Why just single out doctors? All professional services in the country have begun to look rapacious.

As a result, India has created an army of unemployables — for which myopic schemes like Agnipath (https://asiaconverge.com/2022/06/the-burning-questions-behind-agnipath/) have to be created.

Unless India gets its act in order in respect of education (including skill development) and medicare, India’s numbers will continue to remain low. If they worsen, and if unemployment results in violence, India’s sovereign ranking could slip below investment grade.

COMMENTS